With the first quarter behind us, we now have the first chance to look at the 2022 Q1 portfolio performance. And it’s off to a solid start; the yearly return rates for all three markets are outperforming their targets. The quarterly rates for 2021 all increased substantially from last month too. Read more:

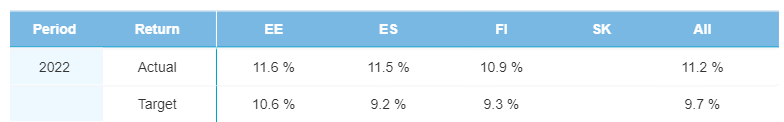

Yearly performance

As we saw last month, 2020 originations continue to decline slightly, this month by 0.1%. But, despite the decline, it exceeds its target rate by 3.1%. The Estonian portfolio outperforms its target by 8.5% and takes the credit for most of the collective 2020 performance.

2021 yearly return rate remains above target by 5.7%—climbing 0.1% from last month. And the yearly portfolio performance for 2022 is looking good. The actual rate of 11.2% is above its target by 1.5%. And all three markets are exceeding their targets—Estonia by 1%, Finland by 2.3%, and Spain by 1.6%.

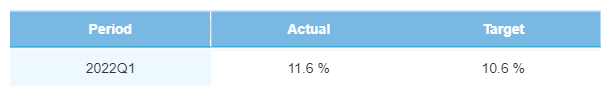

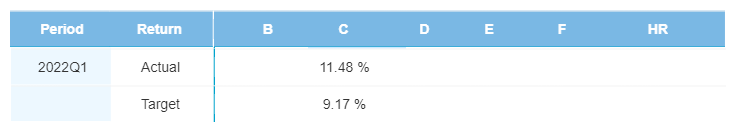

Quarterly performance

The 2022 Q1 is outperforming its target of 10.6% by 1%. This sets a good tone for the rest of the year. Here’s a quick outline of how returns for all four quarters of 2021 performed in March compared to February:

- 2021 Q1: +1.6%

- 2021 Q2: +3.0%

- 2021 Q3: +3.0%

- 2021 Q4: +3.4%

The quarterly return rates skyrocketed from last month, with 2021 Q4 growing the most from March. All 4 quarters, along with 2022 Q1, exceeded their targets. The highest return rate over the past several years is still 2020 Q3. It has an actual rate of 27.2% vs. a target rate of 12.5%.

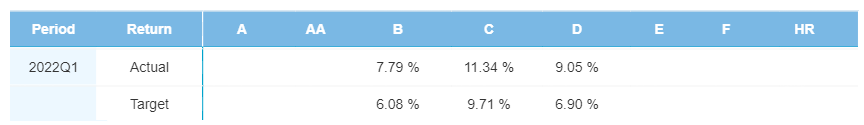

Finland

The Finnish portfolio’s performance is continuing to exceed expectations. The last 5 quarters are all above target. In March, B-, C-, and D-rated risk categories for 2021 Q4 increased. C-rated loans still perform the best, exceeding their target by 1.2%—2.4% less than last month. It seems the growth spurt has subsided but continues gradually. Looking specifically at 2022 Q1, C-rated loans have the highest performance with 11.3%, followed by D-rated loans with 9.1%, and B-rated loans with 7.8%.

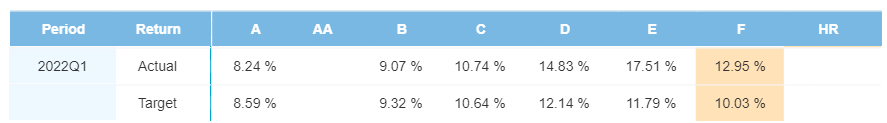

Estonia

Things are still looking good for the Estonian portfolio. From 2020 Q3 until 2021 Q4, all risk categories remain far above their target rates. The first look at the 2022 Q1 portfolio shows 4 out of the 6 risk-rating categories exceeding their targets, with only A (0.4-%) and B (-0.3%) coming in slightly below. The newly relaunched 2021 Q4 HR-rated category still has the highest performance rate (40.8% compared to 5.0%).

Spain

2022 Q1 is ahead of target by 2.3%, starting the year positively. We are still only originating C-rated loans in the Spanish market. 2021 Q3 and Q4 still exceed their target rates. 2021 Q4 increased by 0.7%, and 2021 Q3 decreased by 2.4% from February.

The HR-rated category in Q3 continues to decline significantly from 3.0% to -0.4%, but it still outperforms its target of -16.6%. This negative target is because we weren’t origination loans in the Spanish market for most of 2021.

Conclusion

The first look at the 2022 Q1 portfolio performance begins the year positively. The quarterly return rates‘ increases skyrocketed, with 2021 Q4 growing the most. All 4 quarters, along with 2022 Q1, exceeded their targets. The yearly return rates for all three markets are outperforming their targets. All three countries are performing well, with the Spanish and Finnish portfolios gaining impressive momentum.