Go & Grow is Bondora’s most popular product. Launched to the world in June 2018, it already has over 86,000 accounts. Super simple and easy to use, it has attracted investors of all profiles since inception.

Investors want to know more about the Go & Grow portfolio distribution, and that’s why every quarter we dive deep into the product to give you more detailed information.

Here are the most recent figures of Go & Grow, updated as of April 2020:

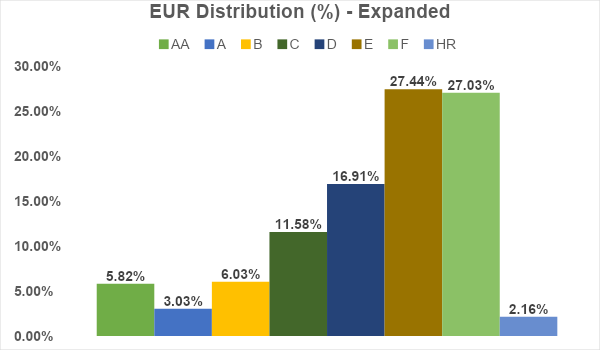

Credit ratings

Bondora always preaches diversification. That’s why instead of investing everything into one credit rating, Go & Grow spreads the claims across different risk ratings, ranging from AA to HR. The lowest distribution is in HR ratings, followed by A and AA.

The largest distribution is in F and E rated loans (27% each), followed by D (17%) and C (12%). Diversification is key: Go & Grow consists of over 109,000 loan pieces and our investors benefit from diversification that traditionally could only be achieved with services such as Portfolio Manager, Portfolio Pro or the API.

The largest distribution still lies within E and F rated loans. As a by-product of issuing more loans in Finland and acquiring new customers, we’ve taken a conservative approach by assigning more borrowers a Bondora Rating of F and E. Essentially, this does not mean the loans in this category are higher risk – however, assigning this rating allows us to ensure our credit model quality is not compromised as we continue to expand in existing loan markets.

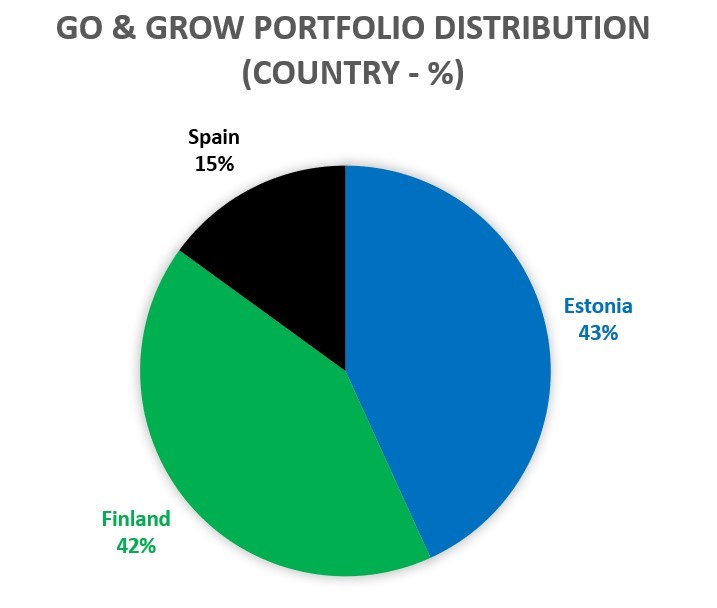

Country of origination

Estonia now accounts for the largest share of the total at 43%, with a narrow lead over Finland at 42%. The share of Spanish loans is clearly in the minority, at 15% of the total. Compared to December 2019, the share in Spain has increased by 2%. In the coming years, we expect Spain to dominate the largest share in our originations.

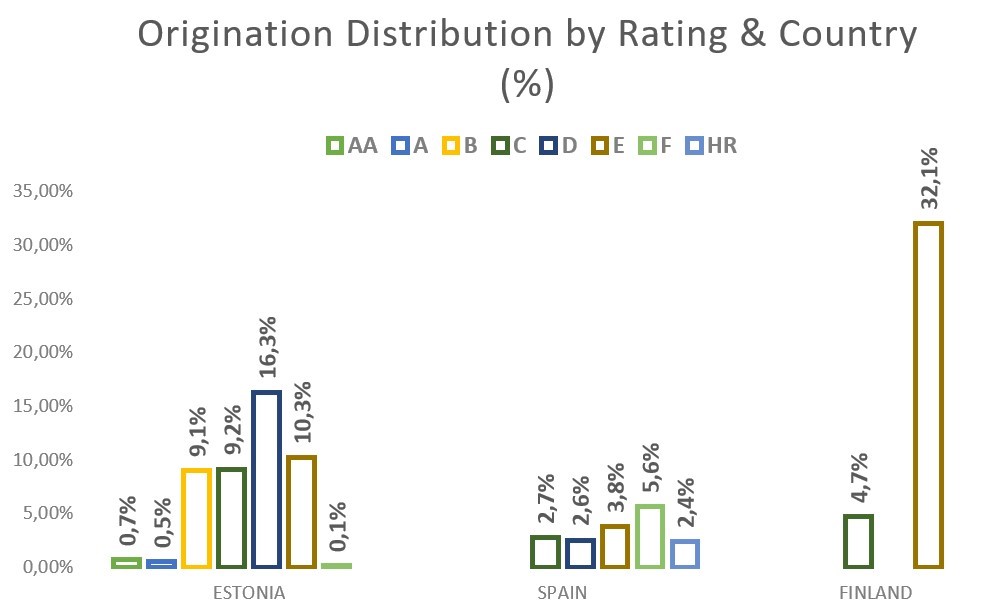

Rating and country

Figure 4a below shows the total distribution of originations across Bondora (not only Go & Grow) in March 2020. If you compare figures 1a, 2a, and 3a with 4a, you can see that the distribution of Go & Grow claims approximately mirrors that of the whole Bondora portfolio. We publish a monthly update on this – click here to read more.

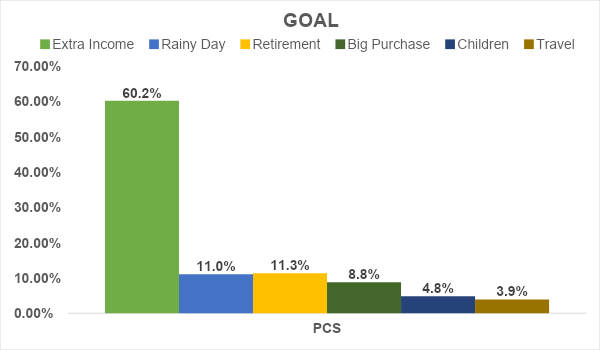

Goals

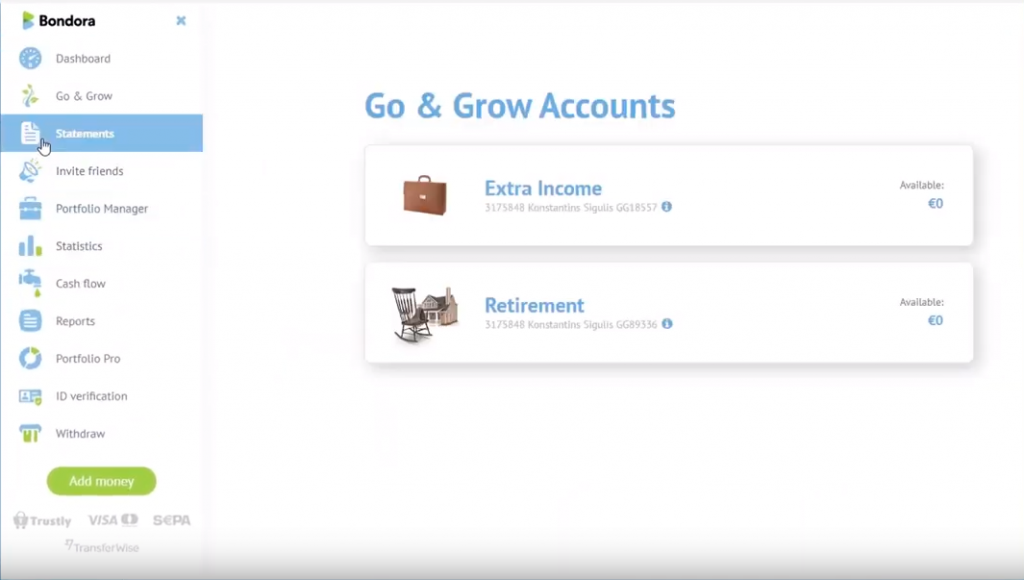

Another interesting point for review is the different goals our investors are striving for. The clear majority is for extra income (60%). However, this is likely to be skewed due to it being the default option. After that, Retirement (11%), Rainy Day (11%) and Big Purchase (9%) follow as the most popular goals.

Go & Grow is built on diversification, but that’s only one of the reasons why investors love this product. See below other benefits of investing through Go & Grow:

Go & Grow generates returns every single day

If you invest with Go & Grow, then head to the “Statements” section on the left-menu panel on your account and you will be able to easily track your returns. The returns are added to your account daily.

Plan your financial future with Go & Grow

If you click on the sandwich icon on the top-right corner of your Go & Grow account, you will find our “Forecast” tool. Use it to simulate investment scenarios and to find the ideal plan for you to reach that long term financial goal of yours.

You can use the Forecast tool to create your very own investment plan and work your way up the 6 levels of financial independence.

Ideal for friends and family

With Go & Grow, investing is simpler than it’s ever been. Now nobody is excluded from taking control of their financial future. That means you can recommend Go & Grow to your uncle who still keeps his money under the mattress, or to that friend who is good at saving money but too scared to invest it anywhere.

5 reasons to choose Go & Grow:

- Up to 6.75%* p.a. net return

- Incredibly easy to use – great for beginners!

- Start with as low as €1

- Pay zero annual management fees

- Create a goal and receive updates on your progress

Is the rate of up to 6.75%* p. a. guaranteed?

The rate is not guaranteed; however, the average net return on the Bondora platform is much higher than this. With this and our 10-year track record in mind, we believe the rate of up to 6.75%* p. a. is achievable.

The net return is capped at 6.75%* p. a. – all excess returns over this percentage are reinvested to ensure you can earn the rate of 6.75%* p. a. going forward, despite there being no guarantee in place.

Ok, what’s the catch?

There’s none. Really. We charge a flat €1 withdrawal fee, no matter the size of the account, and that’s all. This helps us continue to operate the Bondora platform.

Let’s talk about risks

While it’s great to be able to say we’ve delivered on our promises to investors so far, it’s important for us to make sure you’re aware of the risks.

1) The net return falls below 6.75%* p. a.

Although returns are not guaranteed, a headline benefit of Go & Grow is the high-yielding return of up to 6.75%* p. a. Compared to the net return rates achieved since Bondora’s inception, the rate of 6.75%* p. a. provides a substantial buffer. Today, the Go & Grow portfolio mirrors that of the overall composition of the loans originated at Bondora – in other words, across different risk ratings and countries. These loans have been originated using our latest generation of credit analytics, a proprietary model which has been developed for over a decade.

Therefore, the actual Internal Rate of Return (IRR) of the Go & Grow portfolio significantly outperforms the headline rate of 6.75%* p. a. – the returns generated over this amount are held back as reserves and reinvested to mitigate the risk further. Bondora has no claim on these reserves. Overall, this gives us statistical confidence that the rate of 6.75%* p. a. is deliverable for the foreseeable future. But please note that the yield achieved in past periods does not guarantee the rate of return in future periods.

However, a risk which may affect our ability to deliver on the rate of 6.75%* p. a. is the amount of investments we receive from investors. For example, if more money is added to Go & Grow accounts by investors than we can originate in loans – this results in a percentage of the portfolio remaining in cash (i.e., not earning a return). In this scenario, we may decide to add a limit to the amount new investors can invest. In an extreme case, we could decide to stop accepting new investors altogether and form a waiting list – similar to Zopa in the United Kingdom.

2) Liquidity

The plan for Go & Grow was always to have a product with fast liquidity for investors. To create it, we analyzed close to a decade of cash flow data on Bondora investor transactions to determine the inflows, outflows and how the portfolio cash flows moved overall. This is so investors can rely on being able to withdraw money from their Go & Grow account at short notice.

In addition to this, we analyzed cash flow data from a number of banks and investment funds – specifically, their redemption and withdrawal cash flows, during the global financial crisis of 2007-08. This, combined with our own data, has given us necessary information to mitigate the liquidity risk as much as possible.

In the event Bondora cannot fulfill all withdrawals from Go & Grow, there are two scenarios which will follow (and will be decided by whichever occurs first). We have simplified them into two short points below, however for a full description, please read section 7.6. of the Go & Grow Terms of Use.

- The investor will receive their full withdrawal once there’s enough money available in the Go & Grow portfolio, generated via further returns or investments.

- The investor will receive partial withdrawal once there’s enough balance available – paid out each banking day until the full withdrawal has been fulfilled.

More on partial payouts

When we originally built Go & Grow, we knew we had to make a service which was functional at all times, not just in the good times. That’s why we built-in a recession-proof feature called partial payouts.

To protect the return of up to 6.75%* p.a., we have a built-in feature to initiate partial payouts on your withdrawals when needed. This is an automated process that protects your net return and gives you the added benefit of continued stability.

As a core feature of Go & Grow, you don’t have to worry about how fluctuations in the underlying portfolio will impact your return over time. The partial payout protection feature gives investors peace of mind and an added layer of security in times of uncertainty.

Any remaining money which is pending still earns a net return of up to 6.75%* p.a., and will continue to until the withdrawal has completed. And don’t worry, the flat €1 withdrawal fee only applies once and is taken after you’ve received the full payment, regardless of whether the withdrawal is completed in parts.

Partial payouts are made on each banking day to your main Bondora account. Everybody gets a share based on the available amount in the Go & Grow portfolio and their withdrawal amount. As a percentage, the amount distributed is equal for everyone.

If you want to know more about Go & Grow, click here.

*Capital at risk. Investments made with Bondora are not guaranteed, nor is the preservation of value invested guaranteed. Please note that the yield achieved in past periods does not guarantee the rate of return in future periods. The yield of Go & Grow is up to 6.75% p.a. Before deciding to invest, please review our risk statement and consult with a financial advisor if necessary.

It may not be possible to liquidate assets or withdraw money immediately from Go & Grow. In this scenario, we will make partial payouts of your total withdrawal amount. Read more about partial payouts here.