What happens after a loan defaults, and how much is actually recovered? That’s one of the most important questions for both investors and borrowers. In this post, we explain how Bondora works to balance recovery with fairness and support.

In our previous article, we discussed the details of defaults and how we use their data to reflect and build even stronger risk management strategies for a healthier portfolio.

Recoveries play a critical role in long-term investment returns. While defaults are a normal part of lending, what truly matters is how effectively we recover the unpaid amounts. At Bondora, we’ve developed a structured, multi-step process that delivers results while treating every customer with fairness and respect.

What are typical recovery outcomes?

Before diving into the process itself, let’s look at the results.

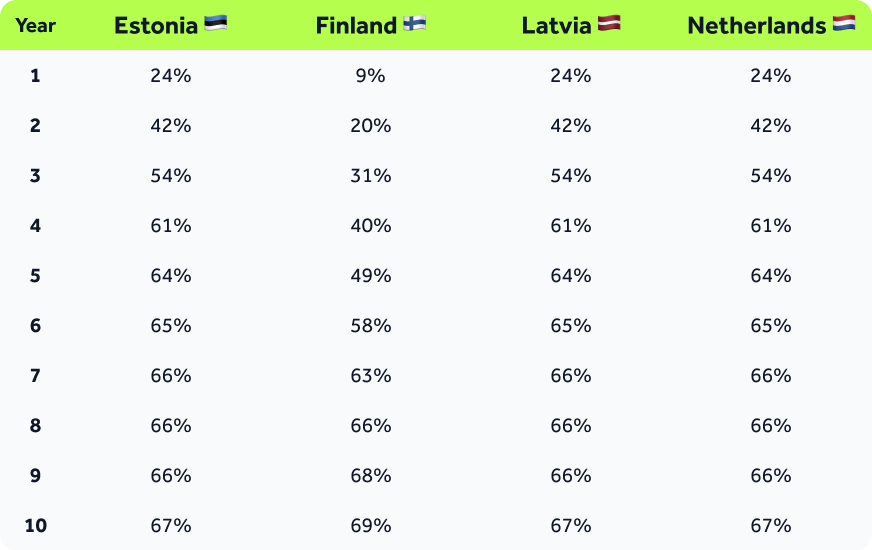

Here’s how much principal is typically recovered on a €1,000 loan that reaches default in these markets:

- Estonia: €667

- Finland: €689

- Latvia: €667

- Netherlands: €667

These projections are based on a 10-year period and historical recovery data. In newer markets like Latvia and the Netherlands, we use comparable country data and early trends to estimate outcomes.

Cumulative recovery over time as a share of the defaulted principal amount

In the first three years after default, we typically recover between 31% and 54% of the outstanding principal, depending on the country. These repayments accumulate gradually, year after year, through our structured recovery efforts.

While these figures are averages and can vary by case, they offer a reliable benchmark for what to expect over time.

While legal steps may be part of the journey, many repayments are made through collaborative efforts over time. Consistency and patience matter; recoveries often take time, but they do add up.

Our 4-step recovery process

We follow a consistent four-step process to recover funds from defaulted loans. This ensures legal compliance, effective results, and respectful treatment of credit customers in every market.

Step 1: Internal collections

We contact the customer as soon as a payment is missed, long before the loan is officially defaulted.

Our in-house team contacts the customer by email, SMS, post, or phone to offer support, explore repayment options, and help them stay on track.

This early intervention is critical: in up to 97% of cases, we help customers avoid immediate default, which increases the chance of long-term recovery outcomes. It also gives our customers the opportunity to recover financially, avoid legal action, and regain stability.

Step 2: Debt Collection Agency (DCA) – amicable collections

If the loan reaches 90 days overdue and the contract is terminated, it moves into default. At this stage, we transfer the case to a trusted Debt Collection Agency (DCA).

This reputable third-party partner then reestablishes contact with the customer, using local expertise and market presence to encourage repayment.

The goal remains to resolve the situation through open communication and a realistic, manageable payment plan that aligns with the borrower’s financial situation.

If reaching an agreement isn’t possible, the case transitions to the next recovery phase. This transition is handled carefully, ensuring that the customer’s circumstances are considered while continuing to move the case forward responsibly.

Step 3: Court

If other resolution attempts don’t succeed, we may proceed with court filings as a last resort, always considering the borrower’s rights and the legal framework in each country.

The timeline varies by country, but on average, a court decision is reached in 2–6 months.

Step 4: Bailiff

Once we receive a court ruling, we hand the case over to a local bailiff. They operate within strict legal guidelines and help manage repayments in a structured, regulated way that considers the borrower’s income and personal circumstances.

Recovery efforts focus on the customer’s available income and assets, always respecting legal guidelines and protections. We receive regular updates to monitor progress and ensure the case stays active.

How does this process vary by country?

While the four main stages apply across all markets, each country’s legal system influences how the recovery process unfolds. Here’s a closer look:

🇪🇪 Estonia

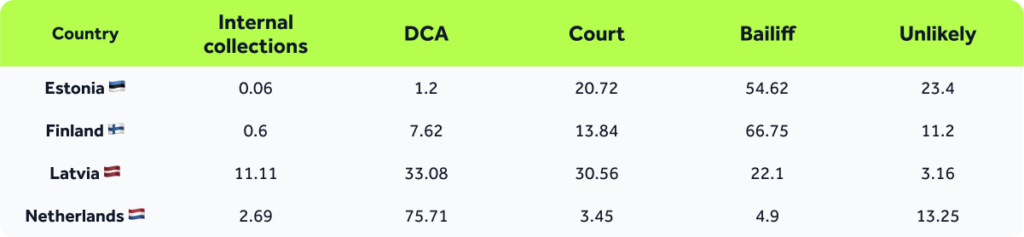

Once a loan defaults, cases are quickly taken to court. Most recoveries are then handled by bailiffs, who operate under a structured legal framework. Thanks to the efficiency and authority of the bailiff system, over 80% of recoveries in Estonia happen at this stage.

🇫🇮 Finland

Cases move swiftly through the recovery process. Loans are sent to a DCA a few days after default. To maintain momentum in the recovery process, cases typically move forward within a few weeks if no agreement is reached, though we always aim to resolve issues amicably first. This fast pace helps keep recovery active and efficient.

🇱🇻 Latvia

After default, loans are first handled by DCAs. If no resolution is found, the case goes to court (typically within two months) and then on to enforcement if necessary. While newer, the Latvian process is aligning with those in other mature markets.

🇳🇱 Netherlands

Most cases are currently managed by DCAs. Over 70% of defaulted loans are under active DCA management. At the same time, we’re refining our strategy to move more cases into legal recovery as systems mature.

How loans are currently distributed by stage

Here’s a snapshot of where defaulted loans stand today in the recovery journey:

*Unlikely cases include bankruptcies, deceased borrowers, or long-term restructurings. These are still monitored, but recovery outcomes are harder to predict.

Why this matters for your investment

At Bondora, recoveries are never just about numbers; they’re about protecting your investment with a strategy that’s respectful, consistent, and tailored to local laws. Just as importantly, we aim to help our credit customers manage their finances responsibly, avoid legal challenges, and find sustainable solutions. We treat every individual’s situation with care, respect, and empathy, because behind every loan is a real person.

Our approach helps ensure that even when defaults happen, you continue to earn stable returns as repayments are recovered in the background.

Transparency, fairness, and long-term thinking are at the heart of how we manage every case.

📣 Have a question about defaults or our statistics?

Share your thoughts via the feedback form and help shape what we share next.

If you are a customer facing payment difficulties, please do not hesitate to contact us. Our team is here to listen and work with you to find a suitable solution. You can find our contact information on our website or in your account.