When it comes to personal finance, everyone seems to be worried about their income. How high is their income, how can they raise their income, and comparing the amount of money they make with friends and family.

Yet, income isn’t actually what people should be focusing on when trying to determine their wealth. Instead, the focus should shift more to net worth instead of income to really measure their true wealth and financial health of an individual. Net worth, not income, is the real measure of wealth.

Difference between net worth and net income

People often get caught up in how much income they earn. This is because income is the primary source of creating wealth for individuals. Although, income is not wealth itself, and generating income does not always lead to wealth creation.

Instead, wealth should be measured in net worth. Net worth is the value of all assets minus all liabilities at a given point in time. Through net worth, a better sense of wealth can be garnered, whether that wealth is directly in cash or assets with an equivalent cash value. Net worth doesn’t discriminate as to where money has come from, whether it is from your primary source of income, home equity, investments, a trust, or any other source.

When it comes to wealth, income doesn’t really matter because income doesn’t guarantee that your wealth will increase. That said, people with higher incomes often have higher net worths, but this correlation does not always play out in the real world. For instance, someone in their 50s might have a lower income because they are slowing down in their work, but could have a net worth in the millions from growing their wealth over the years.

How to calculate your net worth

Calculating your net worth requires compiling a list of your assets and liabilities in order to determine your total worth. Your assets are totaled and then subtracted by any liabilities or outstanding debts you might have. Let’s look at a few examples of net worth and how it is calculated.

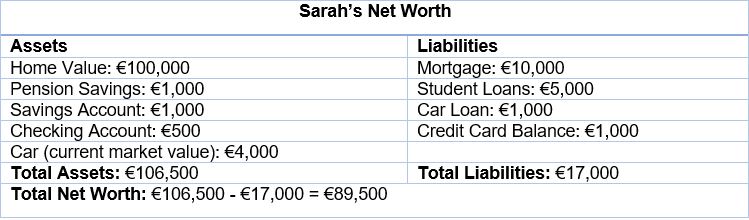

Sarah has lived in a modest home for many years, having paid off most of her mortgage. She has also worked hard to pay off her student loans and carry as little debt as possible.

Sarah has done quite well for herself given she has a modest income (€30,000). By saving her money and paying off her debts she has generated a growing net worth which she can continue to add to over the years.

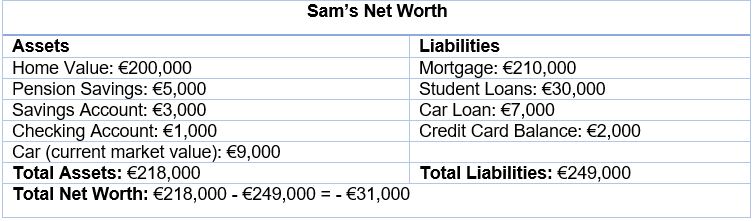

Sam is a college graduate who recently bought his first home, maybe even before he was ready. By all accounts he has a good job which pays him a decent salary (€50,000), but, with his new home purchase and his outstanding student loans, Sam’s financial health doesn’t look as good as it seems.

Even though it appears Sam is financially healthy because his car and home are worth more, the truth is, Sam owes €31,000 more than he has, giving him a negative net worth! This is not a financially sustainable situation, and Sam will have to improve his net worth if he wants to grow his wealth for the future.

As you can see, Sam has a higher asset value than Sarah, but because he also has a significant amount of liabilities and debts, his net worth is in the negative. This highlights the importance of paying off debts and having income generating assets in order to secure more wealth.

Median net worth by age, education, locale and more

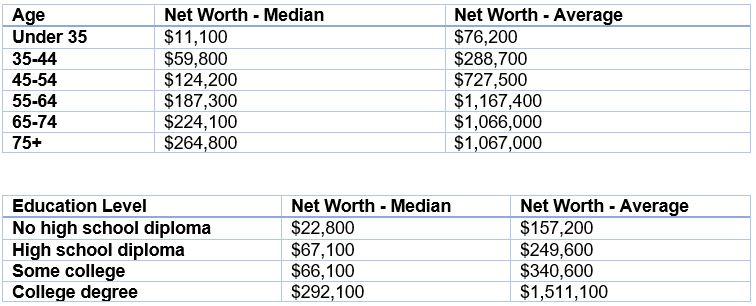

When examining net worth figures, it is better to use the median rather than the average, because the average is skewed by the ultra-wealthy and does not accurately represent net worth on a macro scale.

According to data from the United States census, median, and average net worth is broken down as follows:

It is also clear that homeowners net worth is greater than that of non-homeowners, and that gap is growing. The median net worth for homeowners increased by 15% to $231,400, while the median net worth for non-homeowners dropped by 5% to $5,200.

Still, net worth is relative to the place you live. For instance, the average household wealth in the United States is $176,076, while in Turkey it is only $4,429. This makes net worth relative to your location, where things like cost-of-living, housing prices, taxes, and other factors play a role in net worth totals.

Ways to improve your net worth

Paying off debts, whether they are student loans, car loans, or credit cards, are the best option whenever possible. This is because these liabilities carry interest rates which will continue to pile on over time, adding to your debt and diminishing your net worth slowly over time.

If debts are adequately paid down, funding your investment accounts are another way to improve your net worth. Investments are a way to grow your net worth over time without any additional work — for instance, the passive-income generated via Go & Grow.

Owning a home is another way to improve net worth. This is because renters retain no wealth from their rent payment each month, whereas homeowners obtain more equity in a home with each monthly mortgage payment. This home equity could be sold for cash later down the line, or given to children and grandchildren in the form of inheritance. On the other hand, you might choose to invest the money which you would otherwise use for a down payment on a home. Depending on the amount, this could have a significant impact in growing your net worth (much more than buying a home) if you invest wisely.

How important is real estate in this equation? Well, according to previous census data in the United States, average net worth came out to $80,039 per household, but this number dropped down to $25,116 when real estate was taken out of the equation. Read more about our take on the rent vs. buy debate here.

Watch your wealth grow

You might be looking at your net worth and wondering if you will ever find the wealth you dream of. Remember, it isn’t just about your income and how much money you make from your day-job. Your net worth can grow through a variety of means, as long as you don’t hold on to your liabilities and pay off your debts as soon as possible. You’ve got to start somewhere, and watching your net worth grow over time will give you the motivation to continue building your wealth toward a brighter financial future.