In April, both originations and investment funding grew strong and set new highs for 2022. Loan originations increased by 7.2% to €15,697,955 and investments by 7.3% to €15,548,882. Take a closer look at how the figures increased from March.

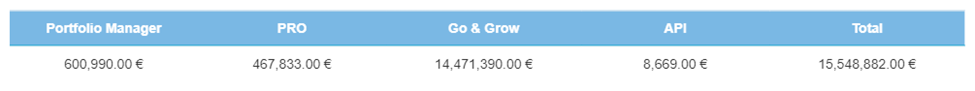

The total value of investments trumped the previous 2022 record high. A total of €15,548,882 was invested during April—a 7.3% increase. Unsurprisingly, Go & Grow takes the majority lead with €14,471,390, Portfolio Manager follows with €600,990, then Portfolio Pro with €467,833, and lastly, the API with €8,669.

Product funding figures:

- Go & Grow + 7.5%

- Portfolio Manager + 4.9%

- Portfolio Pro + 3.6%

- API + 0.1%

All the investment products had positive increases and Go & Grow had the highest growth rate with 7.5%. All the products, except Portfolio Pro, which went from a 5.0% to a 3.6% growth rate, increased their growth rates from March. The API had the most impressive growth, increasing from ‑8.7% to a positive growth rate of 0.1%.

Investment by product

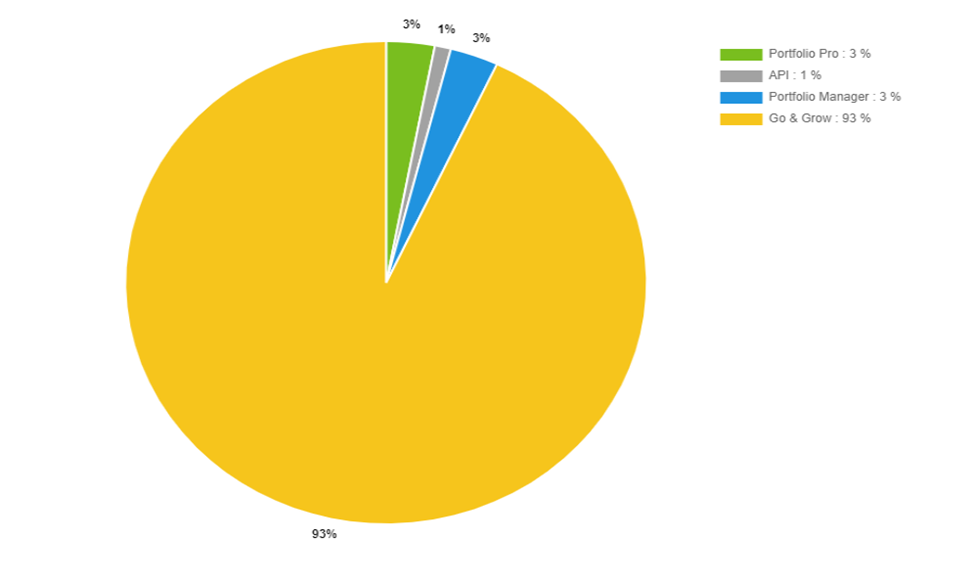

The total shares of Bondora investment products remained virtually unchanged. Only when looking at the decimal figures do we note minor changes:

Go & Grow increased from 92.9% to 93.1%—equal to €14,471,390 in April. Portfolio Manager has a total of €600,990 invested—a 3.9% share (compared to 4.0% in March). In 3rd, we have Portfolio Pro, an investment of €467,833—a 3.0% share (compared to 3.1% in March). And lastly, we have the API, which still has a 0.1% share—equal to €8,669.

Loan originations

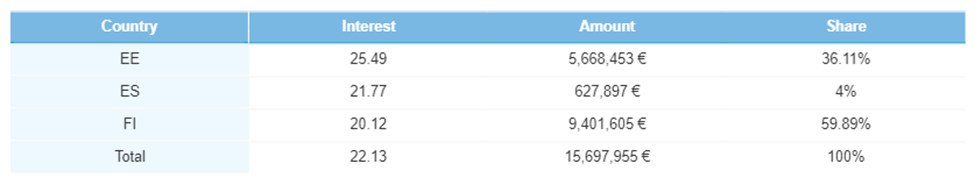

Continuing March’s growth, loan originations increased again in April. A total of €15,697,955 was originated—a 7.2% increase. The average interest rate increased quite noticeably from 20.7% to 22.1%. Here’s a breakdown of all the origination stats:

Country breakdown

Once again, the most significant increase came from Spain (+26.6%), with €627,897 being originated during April. Spanish loans now have a 4.0% share. The 2nd most significant increase came from Estonia (+10.4%), with €5,668,453 originated, a 36.1% share. Finnish loans increased by 4.3% to €9,401,605. The Finnish loans‘ total share receded to its February percentage of 59.9%.

The average interest rate increased noticeably from 20.7% to 22.1% (compared to +0.03% in March). Once again, this can be attributed to the fluctuating Estonian interest rate that increased from 22.5% to 25.% (+3.0%). Compared to the average Spanish interest rate (-0.4%) and the average Finnish interest rate (+0.6), this is quite the change.

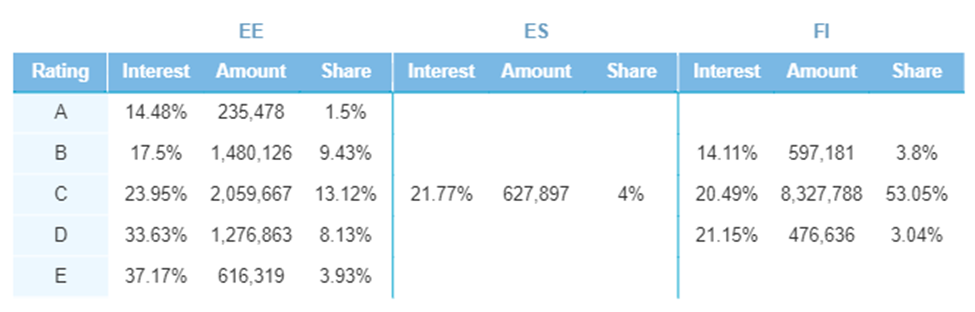

Slowly taking a bigger share of loans each month, Spain’s share of loans increased from 3.4% to 4%. At the moment, we are still only originating C-rated loans in Spain. This risk-rating category is also the most popular in our other markets. In Finland, C-rated loans make up 53.1% of all loans. And in Estonia, the same category’s share is 12.1%.

The D-rated loan category share nearly doubled from 4.1% to 8.1% in Estonia. In Finland, B- and D-rated loans decreased by 1.3% and 0.2%, respectively.

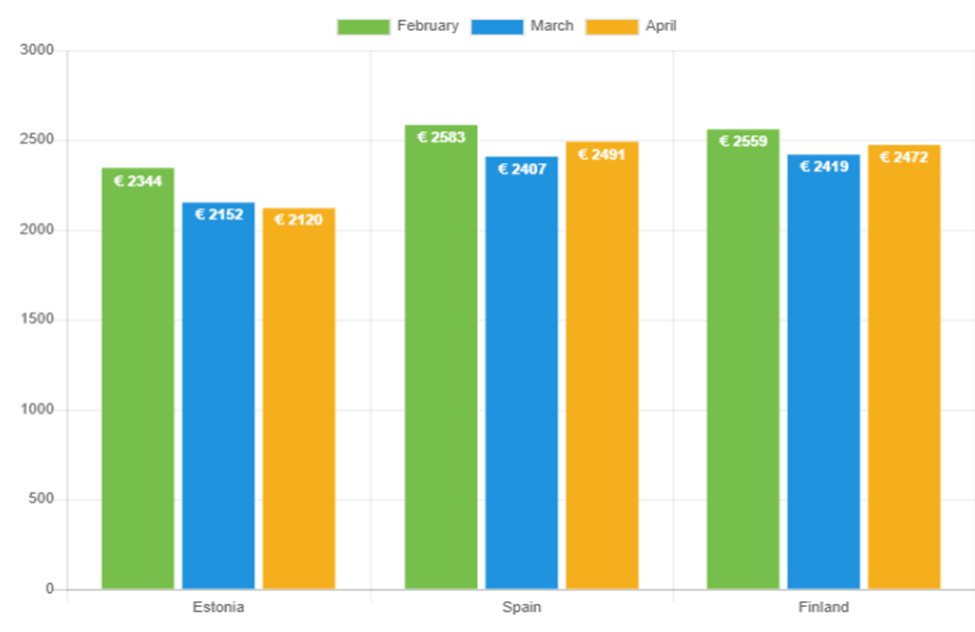

Loan amounts

The average loan amount increased in Spain (+3.5%) and Finland (+2.2%), but decreased slightly in Estonia (-1.5%). This is now the 7th month in a row that Estonian loan amounts have declined.

Continuing the see-saw trend from the last few months, Spain takes the lead from Finland with the highest average loan amount (€2,491). Finland is hot on its heels with €2,472. Estonia lags far behind with €2,120.

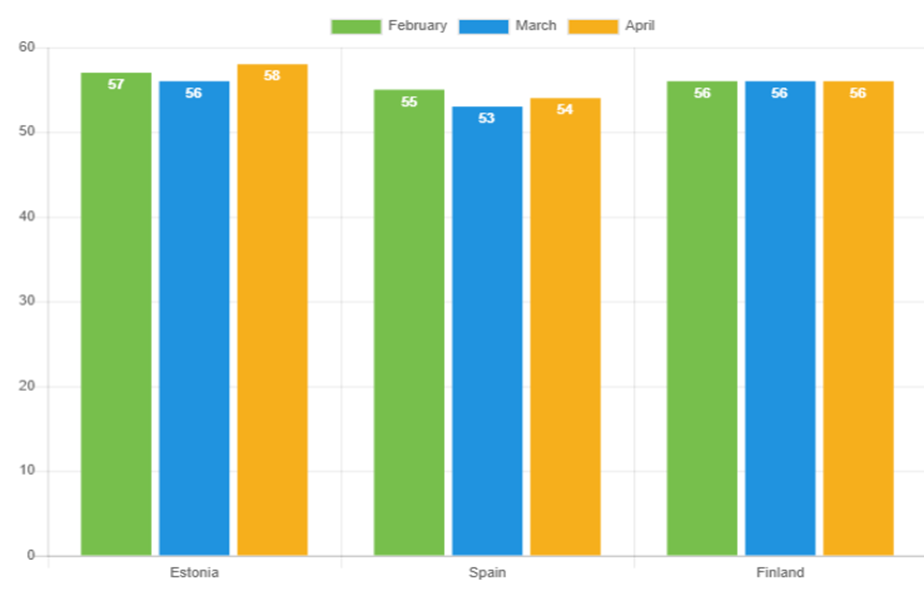

Loan duration

For the first time in a while, all three markets‘ average loan duration lengths are different from each other. Finland remains unchanged at 56-months, but Spain increased by two months and Estonia by one. Estonia now has the most extended loan duration, with 58 months.

60-month loans remain the most popular across all our markets. This duration has the consistent majority in each country. In Estonia, 2,117 loans were issued in this category; in Spain 195, and in Finland 2,876. 24-month loan durations are the 2nd most popular in Estonia. In Spain and Finland, 12-month loans are the 2nd most popular, with 14 and 185 borrowers choosing this duration.

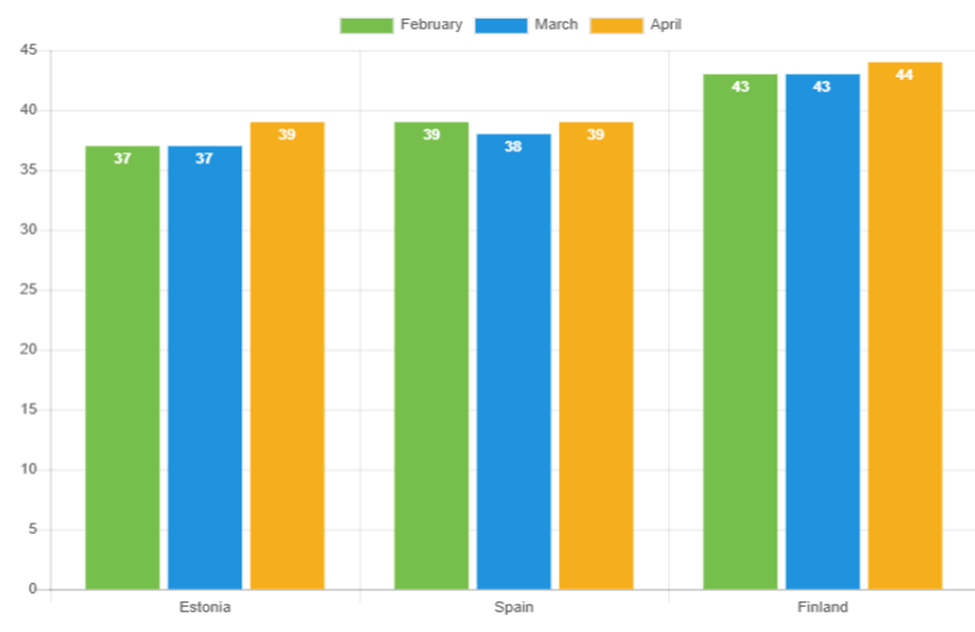

Average age

We see some variation in the average borrower age as each market’s age increased. Finnish borrowers remain the oldest by far, with 44 years. Estonian borrowers and Spanish borrowers‘ average age increased to 39 years old.

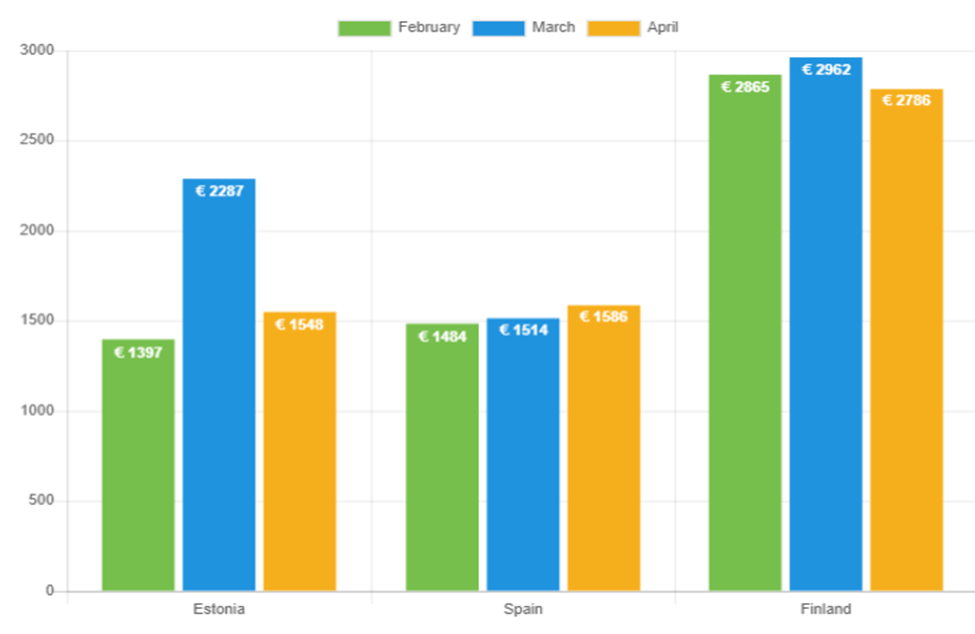

Income

After increasing across all markets in March, Spain was the only market to have an increase in the average net income in April. They increased by 4.8% to €1,586. Finnish loans decreased by 5.9% to €2,786. It’s still the highest average by a landslide. The Estonian market had the most significant drop, declining 32.3%. This drop means Estonian borrowers have the lowest average monthly net income in April.

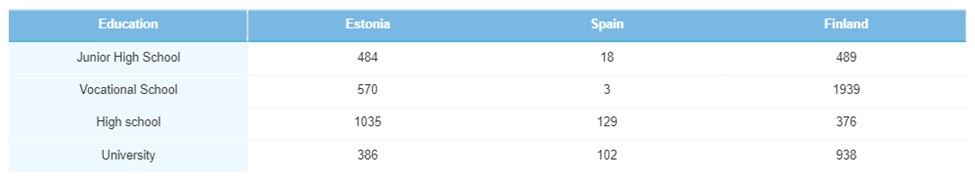

Education

April remained primarily unchanged from March’s education statistics. Again, most borrowers have Vocational school qualifications (38.8%), mainly due to the bulk of Finnish borrowers who fall into this category (51.8%). Second is borrowers with high school qualifications (23.8%). In both Estonia (41.8%) and Spain, this is the most popular category, and in the latter, it increased from 47.1% to 51.2%.

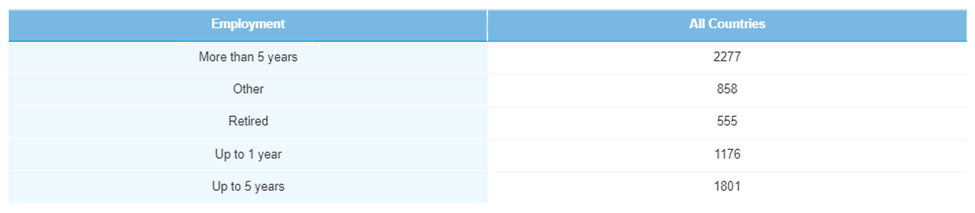

Employment

Once again, the employment statistics remain consistent with previous months. Most borrowers (33.6%) are employed for more than 5 years. Those employed for up to 5 years account for the 2nd largest share of all borrowers (28.1%). And retirees remain the least populated segment, accounting for just 8.2% of borrowers.

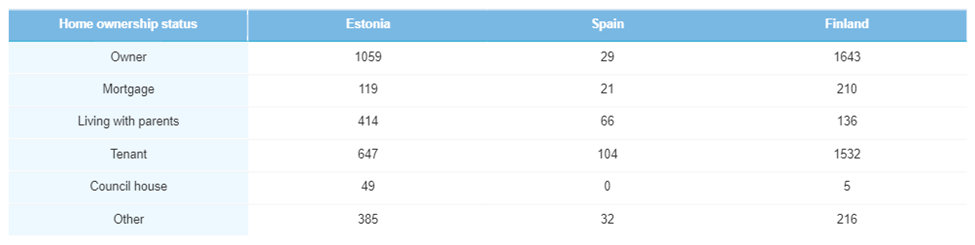

Homeownership status

Once again, across all three markets, the most popular category is owning a home (41.0%). The 2nd most popular is being a tenant (34.2%). As with previous months, this trend is mirrored in Estonia and Finland. However, in Spain, the picture looks different. In Spain, most borrowers are tenants (41.3%), and the 2nd most popular category is living with parents (26.2%). Homeowners make up only 11.5%.

Verification status

We have unverified borrowers in all three markets for the first time in months. Estonia has a 91.4% verification rating, Spain 98.4%, and Finland 99.97%. This brings the total verification rate to 96.5%.

New origination and investments highs for 2022

After ending Q1 with record highs for 2022, we’re thrilled that Q2 grows on that same momentum. Most of the statistics remained consistent with historical figures, with slight changes here and there. This continued growth and stability excite us for the rest of 2022.