May brought another wave of growth across Bondora Group. We welcomed the highest number of new investors in 2025 so far, and Go & Grow reached a brand-new investment record.

With confidence building and investor engagement climbing, May has truly been a milestone month for the Bondora community. Let’s dive into the numbers!

New investor stats

In May, a record-breaking 5,677 new investors joined Bondora to grow their wealth with ease. It’s the highest monthly figure for 2025 so far. Welcome aboard!

While our 7th Birthday Celebration with its €35,000 prize pool definitely created some extra excitement, we know that people choose Go & Grow for more than just prizes. It’s the simplicity, reliability, and effortless experience that keeps them coming, and staying to grow their wealth.

Do you know anyone who can also benefit from effortless investing? When you refer a friend and they’ve completed the easy signup process and started investing, you both can each earn a cash bonus!

Refer them using your unique code from your Dashboard today.

Go & Grow investments in May 2025

In May, investors added €33,593,458 to their Go & Grow accounts, setting a new monthly record! That’s an 11.7% increase from April’s already-strong total of €30,082,562.

Even though the birthday celebration has wrapped, it’s clear that our community’s trust in Go & Grow remains strong. People across Europe continue to choose Go & Grow for its simple, stable, and hassle-free investing experience.

Returns earned in May

Investors earned €2,786,812 in returns across their Go & Grow accounts in May. That’s a consistent and solid performance, maintaining our dependable momentum, and helping our investors reach their financial goals.

Loan origination stats – May 2025

Loan originations surged in May, with Bondora AS issuing €28,700,018 in loans. The bulk of originations came from Finland and the Netherlands.

Here’s a breakdown by country:

🇫🇮 Finland led with €20,601,736 in originations, up 57.6% from April.

🇳🇱 The Netherlands followed with €4,176,120, a 38.3% increase from the previous month.

🇪🇪 Estonia issued €3,233,511 in loans, up 16.5%.

🇱🇻 Latvia rose to €493,506, a 67.1% increase.

🇩🇰 Denmark saw a healthy rebound with €195,145 in originations, its strongest month since launching recently.

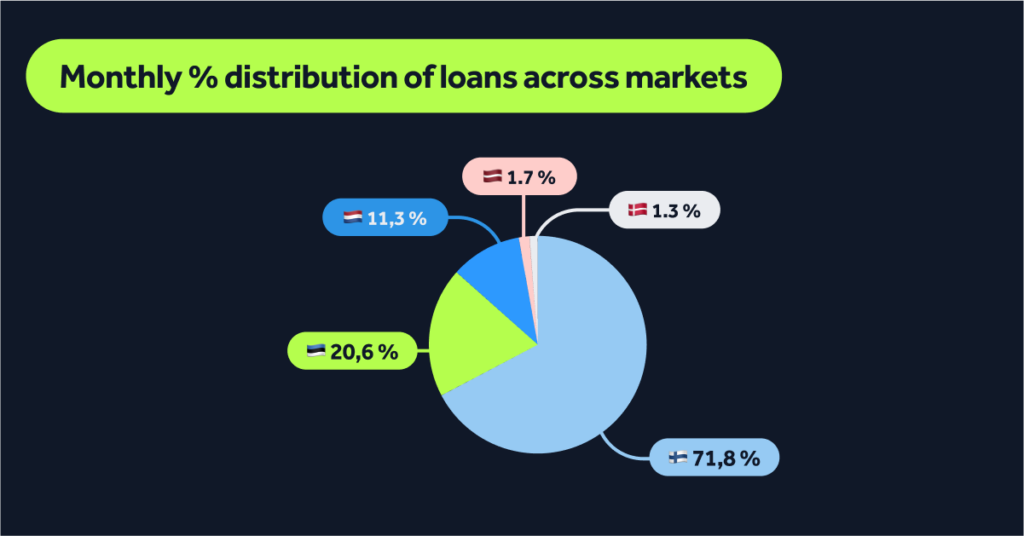

May’s loan origination shares:

- Finland: 71.8%

- Netherlands: 20.6%

- Estonia: 11.3%

- Latvia: 1.7%

- Denmark: 1.3%

Want to understand more about loan defaults?

Ever wonder what it means when a loan is “in default” and how Bondora handles it? We recently published an article explaining it all. Click the link below to read the full blog post. It’s clear, transparent, and easy to understand.

Social media communities

Not following us on Instagram, Facebook, or LinkedIn yet? Join us there for more updates, helpful and fun content, as well as a peek into life at Bondora!