After increasing in July by 18.7%, investment and loan origination figures decreased last month. Investments totaled €14,382,356 and originations €14,405,558 in August. That’s a moderate decline of 6.2% and 6.1%, respectively. Read more:

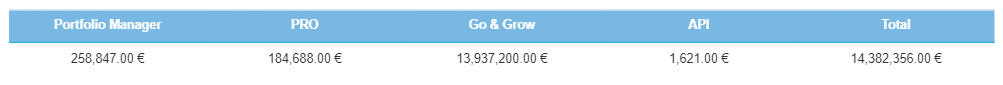

Investment by product

Investors added €14,382,356 to their Bondora accounts. This equates to a mild drop of 6.2% in investments from the increase we saw in July. There was a drop in all product categories, as can be seen below:

Go & Grow – 6.2%

Portfolio Manager – 5.7%

Portfolio Pro – 6.6%

API – 15.4%

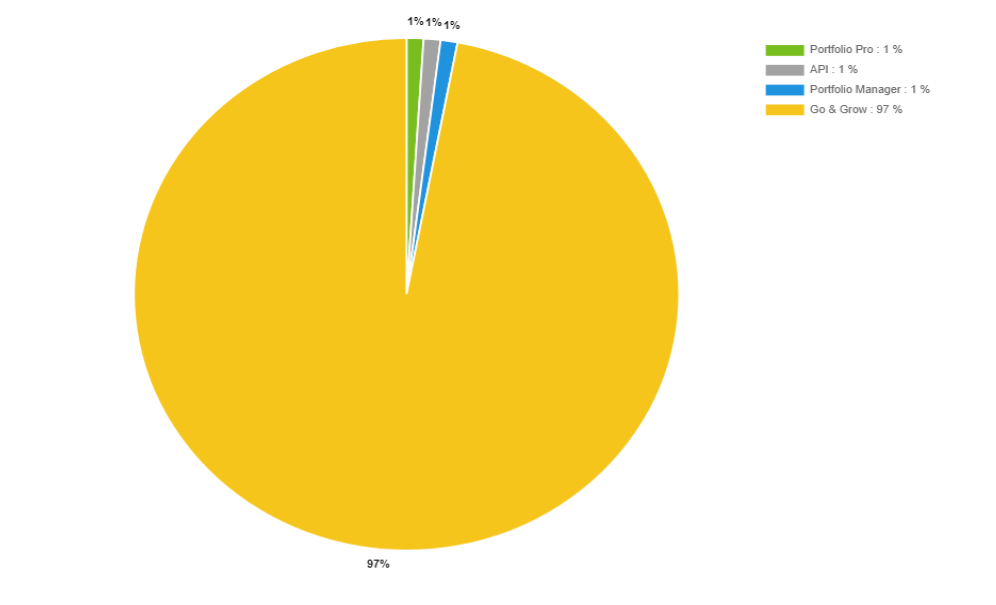

Go & Grow has the largest share of overall funding, making up 96.9% of all investments, €13,937,200. Portfolio Manager remains the 2nd most popular product with €258,847, Portfolio Pro follows with €184,688, and the API trails with €1,621.

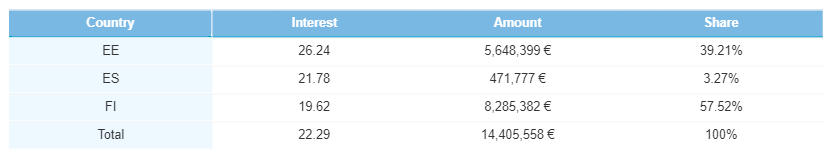

Loan originations

After rebounding in July, loan originations also declined in August, dropping by a modest 6.1% to €14,405,558. This decrease was mirrored across all three countries. The average interest rate increased from 21.6% to 22.3%—reverting to the same percentage as in June.

Country breakdown

In July, Spain had the most noticeable growth, but in August, it also had the most significant decrease, dropping by 25.5% to € 471,777’s worth of originated loans. It is the market that is most prone to significant changes.

The 2nd largest decline came from Finland, dropping by 7.0%. Finland also still has the majority of originations, 57.5%, which equals € 8,285,382’s worth of loans.

Estonia declined by just 2.5%, accounting for a 39.2% share totaling € 5,648,399’s loans.

The average Spanish interest rate remained the same. But Estonia’s average interest rate jumped from 23.9% to 26.2%. In Finland, it decreased from 20.0% to 19.6%.

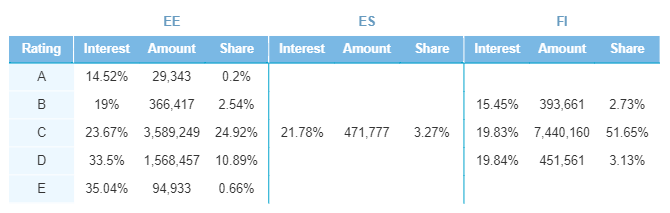

Once again, C-rated loans are the most populated risk-rating category in all our markets. Estonia’s C-rated share greatly increased from 14.9% to 24.9%. It also increased impressively in Finland—43.2% to 51.7%. Because we only originate C-rated loans in Spain, this rating category is identical to the Spanish market’s performance. It makes up a total of 3.3% of the entire loan portfolio.

It seems that in Finland, the growth of C-rated loans meant the decline of D-rated loans, dropping significantly from 12.0% to 3.1%. In Estonia, the 2nd biggest change was in the B-rated category, dropping from 11.7% to 2.5%.

Investments and originations drop mid Q3

Q3 got off to a good start, but in the 2nd month, origination and investment figures started to decline moderately, albeit still totaling over €14M, respectively. We will see if it picks up again in September.

Want to see more detailed information? Head to our public statistics page for the most up-to-date stats!