Even though Go & Grow has resumed investing as normal, Bondora will carry on focusing its efforts on the steady Estonian loan originations.

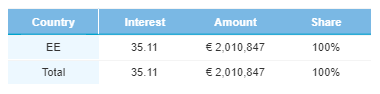

After a very strong comeback of 8.6% growth in May, the overall number of loan originations scaled down to €2,010,847—an 11.4% decrease from last month. The interest rate for Estonian loans saw a 4.3% decrease to 35%. Loan originations in Spain and Finland remain suspended for the time being.

Stable month for Estonian loans

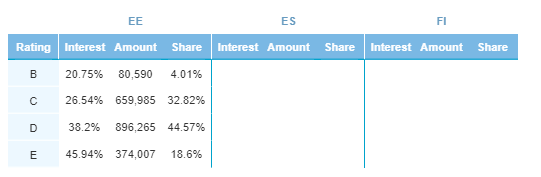

In June, all the rating categories saw an increase, with the exception of D-rated loans – going from 48.5% to 44.6%. It still has the highest share in Estonian originations. C-rated loans saw the biggest increase—climbing from 26.05% to 32.8% of the origination share. B-rated loans’ interest rates remained unchanged, with only slight changes in the other rating categories, indicating a stable month for Estonian loans.

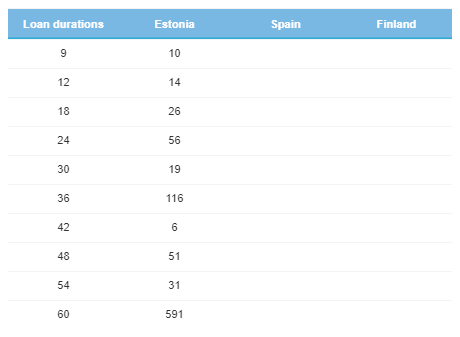

Loan amounts and durations increase further

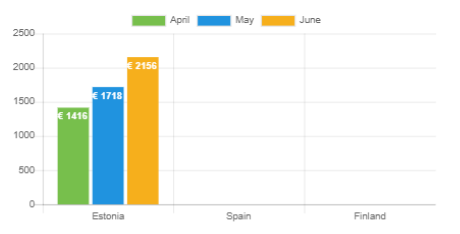

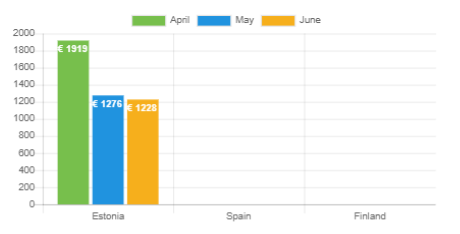

June continues on May’s upward trend as Estonian loan amounts increased significantly. On-the-month we saw a 25.6% increase. That’s 4.3% higher than last month’s growth rate.

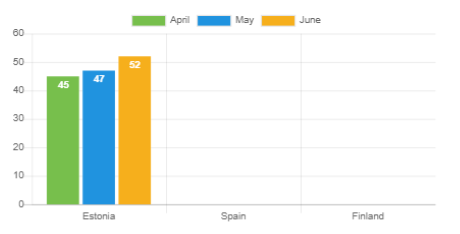

The upward trend is mirrored with loan durations. For the 2nd month in a row, loan durations increased, this time, growing to 52 months. In May, the average loan duration was 47 months.

After recently introducing 54-month loan durations, it has already gained popularity among Estonian borrowers; surging from 4 loans issues to 31 in just one month. 60-month loans still remain the most popular choice with 591 loans in this category.

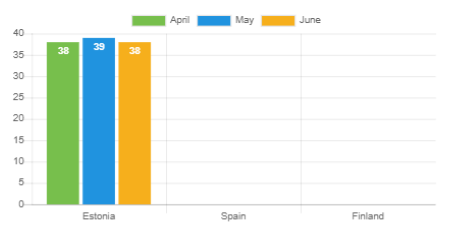

Average age and income remains fairly consistent

The age of the average Estonian borrower remains the same as it has been from March, going back and forth between 38 and 39 years old. This month, it’s back to 38 years old.

Income levels came in a little lower than last month, dropping from a monthly average of €1,275 in May to €1,228 in June. This is the lowest average income of Estonian originators recorded year-to-date.

High school education make up bulk of borrowers

This month, university graduates had a slight decrease from last month’s higher figures. They are, however, still occupying a bigger share this month (13.8%) than they were in April (12.9%).

Estonian borrowers with a high school education remain the biggest percentage of borrowers, accounting for 48.8% of the borrower landscape—a 6.2% increase from May.

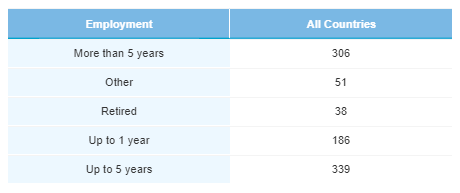

Mid-long term employees on the rise

The employment duration of Bondora borrowers remained more or less the same. All categories saw the slightest of decreases, with the exception of borrowers who are employed for up to 5 years—this category saw a rise of 2.6%.

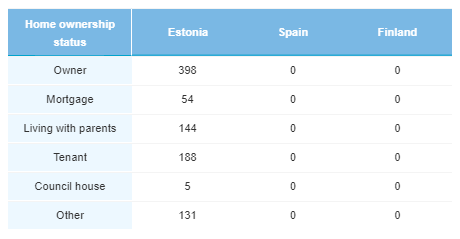

Nearly half of borrowers are home owners

The home ownership status of Estonian borrowers was relatively consistent with previous months. In June, the majority of borrowers were homeowners, comprising 43.3% of all Bondora borrowers, while 20.4% are tenants and 15.7% are living with their parents.

Verification status

Verification numbers continue to climb since April and are showing no signs of stopping. 89.7% of borrowers were verified, compared to 87.2% from May. This is the highest verification percentile rating achieved for Estonia in 2020.

Consistency is key

June marks the third consecutive month of Bondora consolidating originations to maintain stability for customers. Keeping our numbers as consistent and stable as possible, whilst facilitating growth, remains the key focus. Bondora continues to provide investors with trusted opportunities for investment, even during uncertain times.

Learn more about Bondora investment products here and start investing today!