As the season’s change and the weather cools, Bondora is heating up once again. While August saw a reduction in overall originations, the beginning of autumn brought another record month of originations on the Bondora platform.

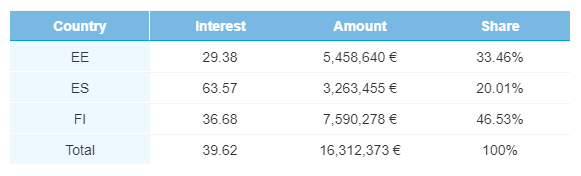

Country Breakdown

In September, originations totaled €16,312,373, up 11.9% from August. Originations in Finland had the biggest increase, up by 25.8% to €7,590,278. Estonian originations were relatively unchanged, while Spanish originations rose slightly by 6.1% compared to last month.

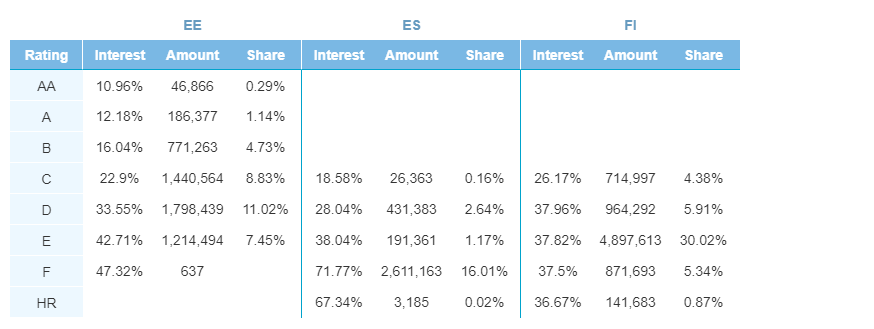

E rated loans out of Finland grew in September to a 30% share of all Bondora originations for the month, totaling €4,897,613. As this share increased, we saw a reduction in Finnish D rated loans (down to 5.9% from 10.6% in August), and Estonian C rated loans (down to 8.8% from 10.7% in August).

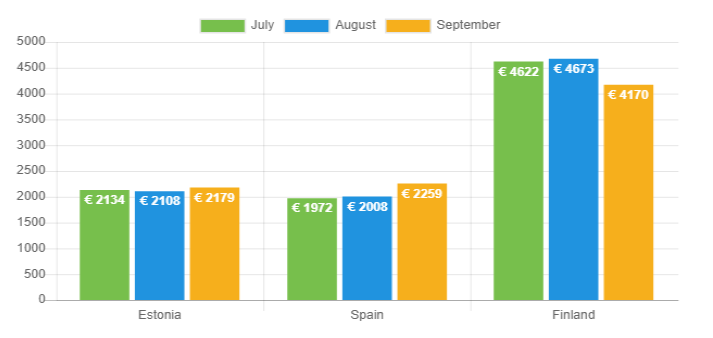

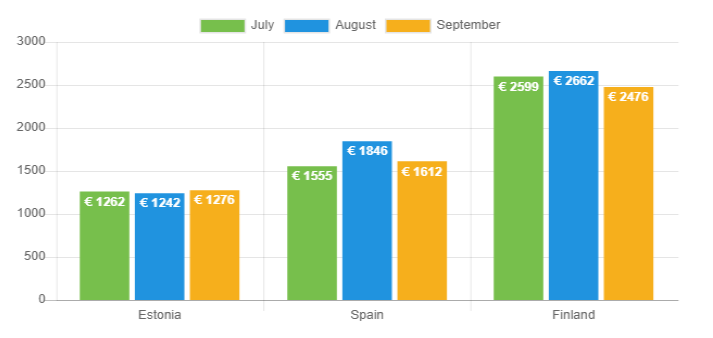

Loan Amounts

While Finnish originations rose in total, the average loan amount dropped by 10.8% to €4,170. Conversely, average loan amounts in Spain and Estonia rose by 12.5% and 3.4% respectively.

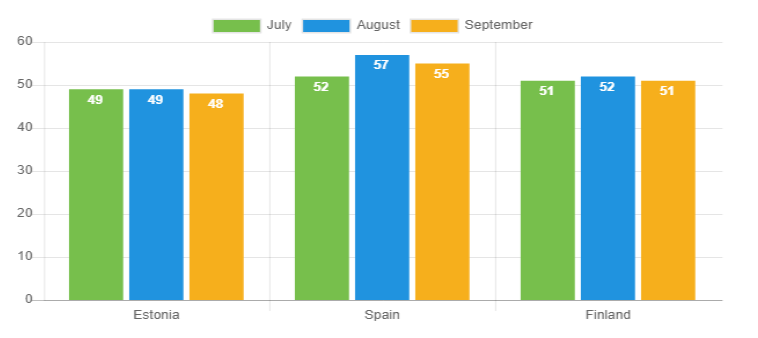

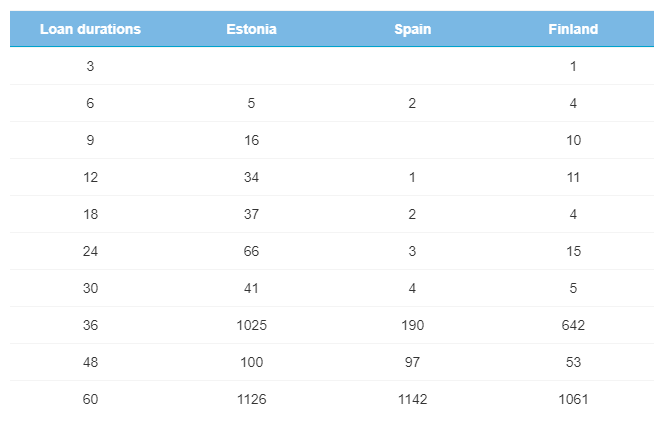

Loan Duration

Average loan durations were stable in Finland and Estonia. Loan durations in Spain normalized down to 55 months, a middle-ground between 57 and 52-month averages from the past two months.

6-month loan durations were almost completely eliminated in September. Spanish and Finnish loans remained almost exclusively in the 36 and 60-month durations, while loans in Estonia had a bigger distribution of loans from 6 to 30 months in duration, composing a cumulative of 8.1% of all loans in the country.

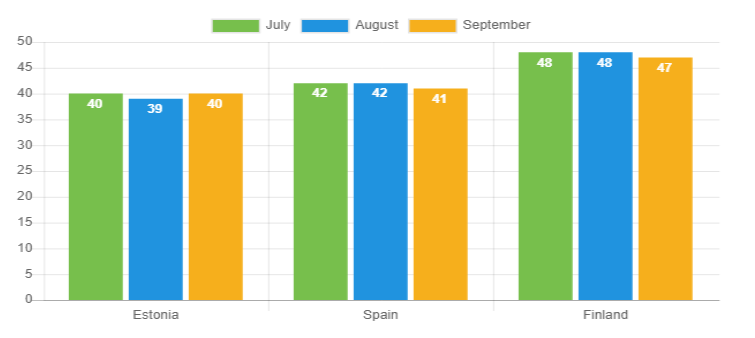

Average Age

The average age of Bondora borrowers remained constant in September. Estonia continues to have the youngest borrowers on average at 40-years old. Finnish borrowers remain the oldest on average at 47-years old.

Income

Incomes for Estonian borrowers were almost identical to the previous two months. However, average incomes decreased from last month in Finland and Spain. The average income of borrowers in Spain fell by 12.7% to €1,612, while borrowers in Finland averaged €2,476 in monthly income, down 7.0% from August.

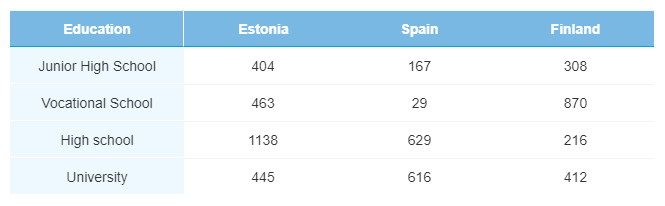

Education

There was an increase in Finnish borrowers with a vocational school education, totaling 48.2% of all Finnish borrowers. Meanwhile, Spanish and Estonian borrower education levels remained relatively unchanged.

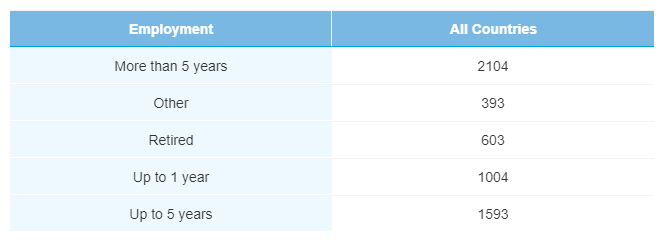

Employment

There was a slight increase in retired borrowers in September, totaling 603 borrowers up from 501 last month. The remaining employment figures were in-line with August’s statistics.

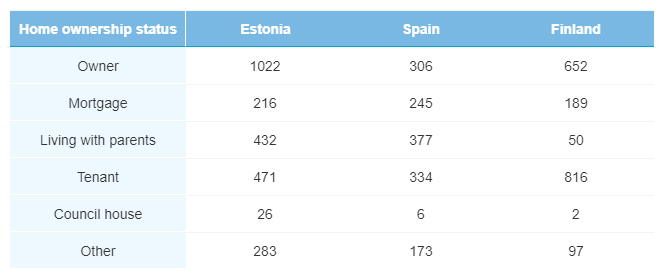

Home Ownership Status

There was an increase in tenant borrowers in Finland, making up 45.2% of all borrowers in the country. Estonian borrowers remain the most likely to be homeowners, with 41.7% of borrowers from Estonia owning their own homes.

Verification Status

Slightly less Estonian borrowers (44.5%) were verified in September. Meanwhile, the verification rate of Finnish borrowers (69.1%) and Spanish borrowers (99.7%) both remained constant.

Breaking More Records

After taking a month off from record-breaking originations, Bondora was at it again, surpassing €16 million in monthly originations for the first time in the company’s history. This increase was led by Finnish originations, which saw a huge increase in total originations, even as the average origination amount decreased. On average, total loan values decreased while loan durations increased, displaying a diversification of originations on the Bondora platform.

Learn more about Bondora investment products here.