Our recent surveys showed that our investors would like to have a better understanding on how Bondora is managed and its risks mitigated. Therefore we will be sharing a lot of behind-the-scenes information on Bondora with our investors over the coming months through our blog and website.

Today we have put together a high level view on how governance and risk management is handled within Bondora.

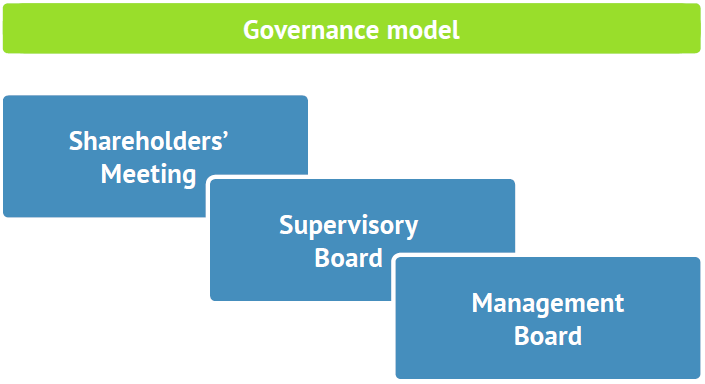

- Bondora Management Board is overseen and appointed by the Supervisory Board that in turn is appointed by a Shareholder Meeting

- Day to day management is carried out by the Management Board

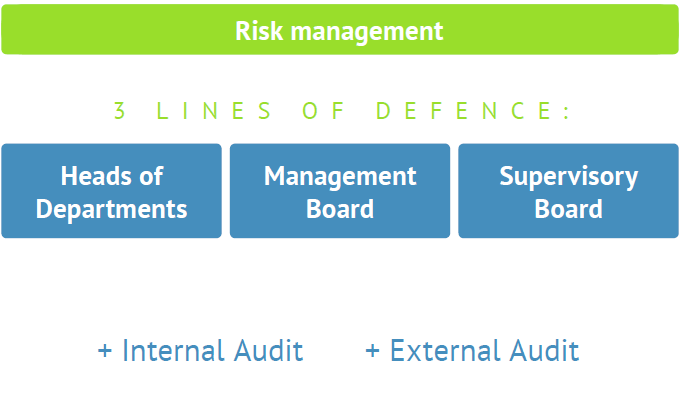

- Risk management is performed by the operational management of Bondora that includes specialists in credit risk assessment, market risk, IT security, operation risk and compliance

- The specific risk management responsibilities are delegated to heads of respective departments who report to the Bondora Board

- Risk management is further reviewed on a quarterly basis by the Supervisory Board

- Internal audit is reporting directly to the Supervisory Board and is carried out by PwC

- Annual IT audit is an integral part of annual financial audit by Deloitte