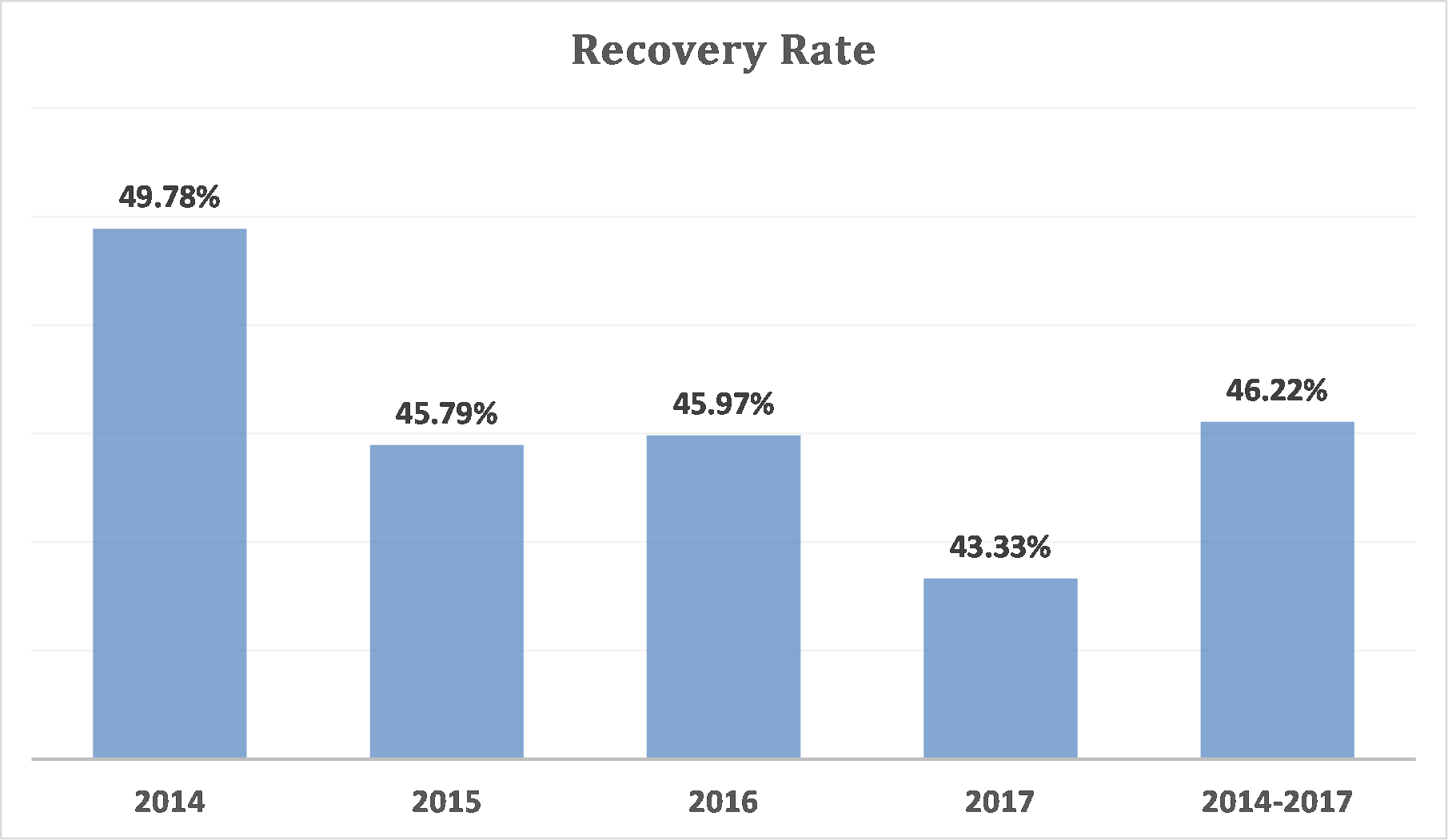

Welcome to our monthly blog post on the performance of recoveries. Below, we take a look at the percentage of principal and interest retrieved between 2014 – 2017.

Why is 2017 showing the lowest recovery rate?

On first glance, this may appear to show that the success of our recoveries process has slightly decreased since 2014. However, it is important to note that the latest year will almost always show the lowest recovery rate. Quite simply, this is because the loan is moving through our 3-step collection process and is not yet generating a cash flow or has only recently started generating a cash flow.

A total of €5,405,446.16 was recovered between 2014 – 2017, an increase of 3.5% since last month.

An increase of 14% in Estonia

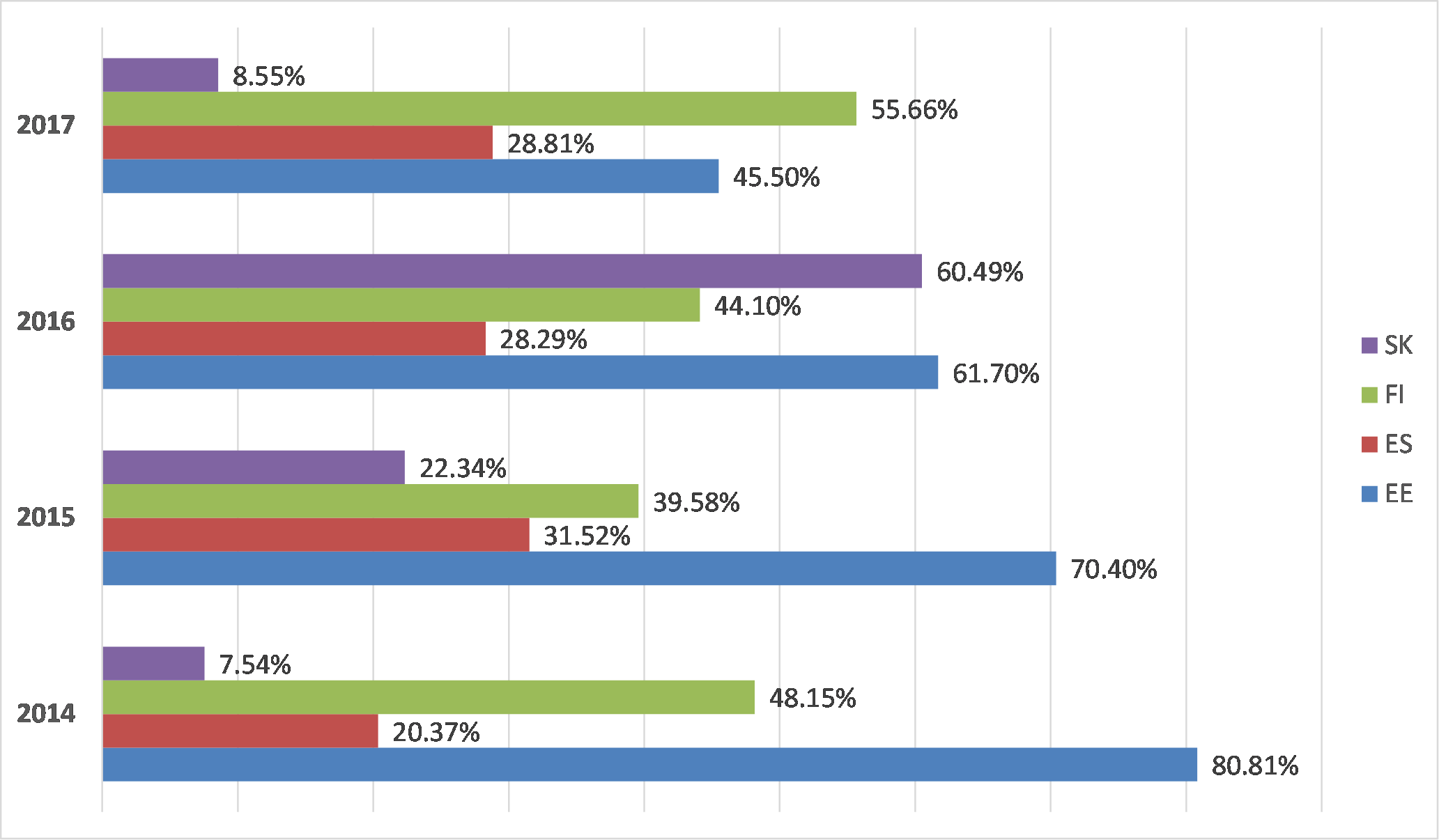

In 2017, the largest amount of cash recovered was in Estonia at a total amount of €349,071.75, an increase of 14% on the absolute amount since last month. However, the highest rate of recovery is still visible in Finland at 56% and a total of €290,156.15. It’s important to remember that these rates will change over the coming months, we explain why below.

Historically, recovery rates have always been the highest in Estonia. Take 2014 as an example, the rate for this period is 81% and a huge €813,724.60 recovered. Looking backwards from 2017, you can see the rate of recovery increase over each year in Estonia as more time is allowed for the cash flows to come in.

Why is this figure different to last month?

After a month or a year ends, investors still receive a cash flow from this time period when the loans were issued. For example, we may still receive a monthly cash flow from a loan that defaulted in 2014. Due to this, the data is consistently being collected and updated to reflect the changes.

What happens when a borrower stops making repayments?

Recently, we published our 3-step collection and recovery process which explains exactly what happens when a borrower misses their monthly loan repayment.