Click here for the German or Estonian video.

Today, experts around the world are debating whether another recession is looming.

Recession is a word that we have all probably heard before, and what follows is often the fear of the unknown. The good news is that a recession doesn’t have to hurt your finances. To be prepared, it’s best you understand the theory behind what it means for an economy, and how you can turn this to your advantage.

Let’s see what a recession is

Contrary to popular belief, economies are not always growing at a steady pace. Economic performance can fluctuate from one period to another – but this doesn’t mean we’re in a recessionary environment. So what is a recession?

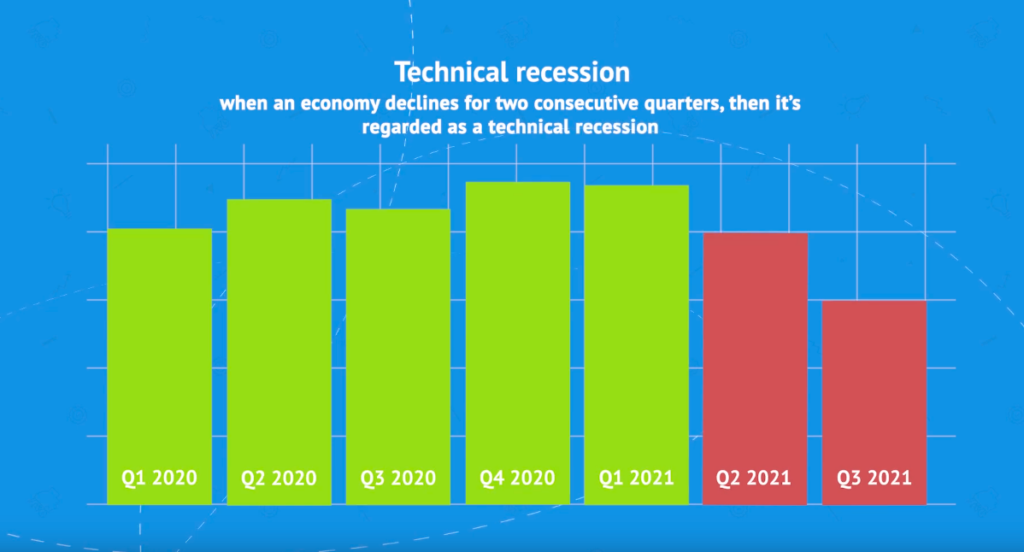

Put simply, when an economy declines for two consecutive quarters, then it’s regarded as a technical recession. Generally, this is identified by two successive quarters experiencing a fall in GDP.

So what’s the cause of a recession?

When an economy hits a period of prolonged expansion, inflation can rise. At some point, the economy will have no more room for growth in its current cycle and will hit a peak. As prices rise, demand from consumers will fall, causing businesses to start cutting their production and reducing employment. This cascading effect of higher unemployment and a reduction in consumer demand, followed by businesses scaling down, is what ultimately leads to an economic recession.

The impact of supply and demand

Here’s one thing that has a significant impact on an economy – the forces of supply and demand. Take, for instance, when there’s a high demand for a specific asset. The price for this asset will rise and may skyrocket. The more buyers believe that the value of the asset will continue rising, the price will continue to rise. Sooner or later, the buyers or investors will realize that the price has been driven up too high and then make a major sell-off, which will cause a sharp drop in the value of the asset.

This is similar to what happened in the 2008 mortgage crisis. The derivatives market underlying home mortgages were thought to be bulletproof until it was found that a significant number of mortgage holders couldn’t pay their debts. The reasons behind this could take a whole video in itself to discuss – but overall, it can be attributed to rising interest rates, inaccurate ratings of the underlying bonds, and irresponsible lending. This caused massive defaults in mortgages, and with it, a collapse in the housing and financial markets almost overnight.

Let’s talk about the concept of recession cycles

While business cycles can be predicted to some degree, their duration and magnitude cannot. Over time, a variety of business cycles have brought recessions of varying degrees. The 2001 post-dot-com recession was short, lasting only 8-months following a quick rise in internet-based businesses. On the flip side, the Great Depression in the United States was devastating, lasting about 10-years and creating 25% unemployment in the country.

Based on historical business cycles, markets are long overdue for a recession. On average, the global economy is in expansion for just over 3-years in each cycle. Today, the economy has been in economic expansion for over 9 years, a significant period given the general business cycle. The latest recession was over a decade ago, meaning, it’s not unreasonable to think another recession is waiting in the wings.

Geopolitics and recessions

Geopolitics can play a role in recessions too. Britain’s exit from the European Union has brought to the surface fears of more countries venturing out on their own, and ultimately breaking the balance of power in the region.

In the United States, President Donald Trump continues his trade war tactics with nations like China, the global economy is suffering. Trump has already instituted 25% tariffs on $200 billion of Chinese goods exported to the US and has shown no signs of backing down.

How is Bondora preparing for a recession?

Every lending decision at Bondora is determined by our proprietary credit modelling system. Taking into account 1000’s of data points, we can accurately assess the risk of any given borrower. And once we issue a loan, we collect data on every single transaction and use this to improve our models.

In the past decade, we’ve operated in recessionary environments in Spain & Finland, and collected first-hand data on customer’s payment behaviours. Overall, this has helped us improve our credit analytics so our risk assessments are well prepared for a larger recessionary environment.

Recessions aren’t all bad

For those who can anticipate a recession, there is money to be made. This makes it extremely important to not panic during a recession. By playing it cool, you can often find ways to make money in these times.

One notable figure who has always seemed to find a way to make money during recessions is Warren Buffet. Buffet noted how the key to coming out on top during a recession is to “be fearful when others are greedy, and be greedy when others are fearful.” Following the most recent recession in 2008, Buffet used his stockpiles of cash to buy assets which he felt were undervalued. This proved to be extremely profitable for the financial guru, as he was able to benefit from a market that scared others away.

Do you need as much money as Warren to make money in a recession? Definitely not. Make sure to do your homework and anticipate what assets might become undervalued when economies are in a downtrend. Doing so will allow you to leverage your knowledge to get positive returns when others are fearful of the markets.

That’s it from us. Hit the subscribe button to make sure you don’t miss out on more interesting topics like this in the future. Thanks for watching, keep investing, and bye for now.

*As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75%. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.