For over 3 years, Go & Grow has been Bondora’s most popular investment product. Launched in June 2018, it now has over 139,000 satisfied investors. And there’s a good reason why it’s so popular: people were tired of trying to figure out complicated investment funds, and Go & Grow makes investing easy and fun. We’re also working on something exciting that will make it even easier than before, but more on that later…

Every quarter, we share a more detailed look into what makes Go & Grow successful: its portfolio distribution. Let’s dive into Go & Grow’s Q3 portfolio:

Credit ratings

Diversification is at the core of our business, and Go & Grow is no exception. Instead of investing everything in only one credit rating, we spread investments across all 8 ratings, from AA to HR. By investing in several different loan pieces across multiple ratings, Go & Grow helps you get the most out of your investment.

D-rated loans continue to make up the bulk of the Go & Grow portfolio. It grew ever so slightly from 24.8% in Q2 to 26.9% in Q3. The distribution of the other categories remains more or less the same as in Q2. As mentioned in our previous quarterly review, the possible reason for this increase in the D-rating category is most likely because of the constant increase in Finnish loans, as all Finnish loans are currently classed in the D-rating category.

E-rated loans come in second with 19.6%, and F-rated loans have the 3rd biggest share with 17.2%.

The outliers HR-, A- and AA-rated loans continue to have the smallest distribution across the Go & Grow portfolio, with HR still having the smallest share.

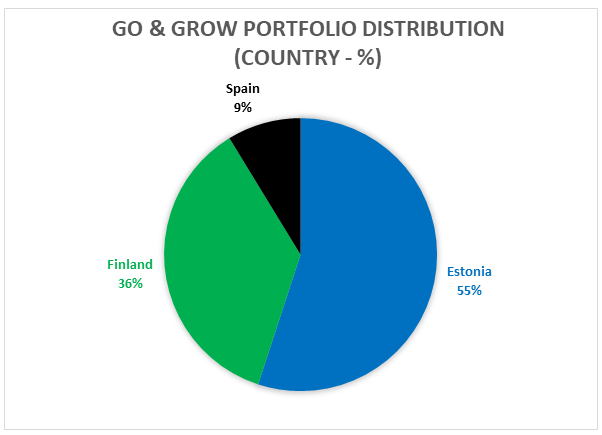

Country of origination

2021 continues to show strong origination growth for Bondora. And Q3 continues on that path. Finnish loans continue to be a direct cause of the massive increases we’ve seen this year.

Finland grew its percentage share of all originations by 1%, claiming 36% of all loans. Estonia, in contrast, lost that 1% share but still holds the majority of 55%.

On 15 September, we relaunched our Spanish borrower market. Spain still accounts for the smallest share of loans (9%), but as we are gradually increasing originations, you can expect to see more Spanish loans available over the next coming months.

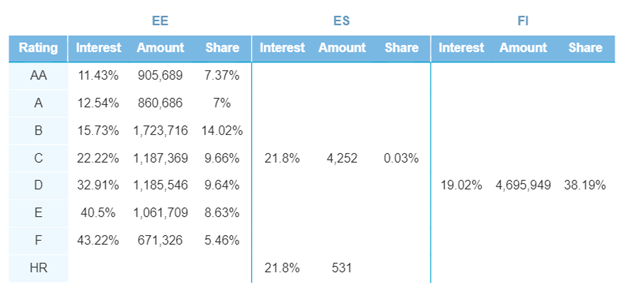

Rating and country

Below, you can see the total distribution of originations across Bondora (not only Go & Grow) in October 2021. If you compare all the figures in this article, you’ll see the distribution of Go & Grow claims approximately mirrors the entire Bondora portfolio. You can read more about the portfolio in our regular updates on our blog.

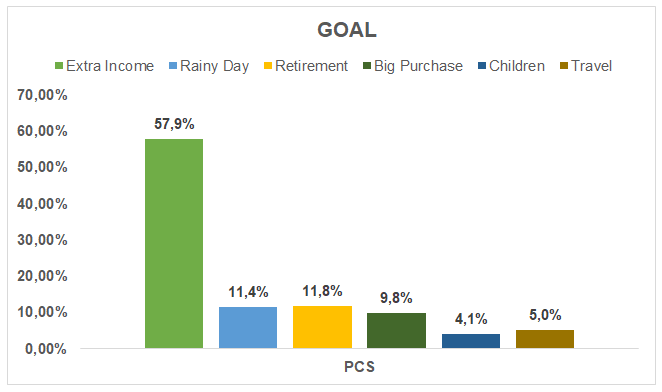

Investment goals

When you have an investment goal, you are more likely to prioritize that investment. That’s why we encourage our Go & Grow investors to choose a goal when they open an account. The chosen investment goal won’t affect your returns in any way, but it’s entertaining to see what people are investing for. The clear majority is Extra income (57.9%), but this has to be taken with a grain of salt, seeing as it’s the default selection.

In Q3, Retirement (11.8%) and Rainy Day (11.4%) remain in 2nd and 3rd place, with both decreasing by 0.1% from Q2.

After that, Big Purchase (9.8%), Travel (5.0%), and Children (4.1%) follow. The last two goals remained unchanged from Q2, except Big Purchase increased by 0.1%.

Why Go & Grow is our simplest way to invest

We like to keep things simple and effective. And we believe that’s what makes Go & Grow so great. There’s nothing complicated; it’s super easy to use and the simplest way to grow your money online.

5 reasons to choose Go & Grow:

🌱 Up to 6.75%* p.a. net return

🌱 Incredibly easy to use – great for beginners!

🌱 Start with as little as €1

🌱 Zero annual management fees

🌱 Create a goal and get updates on your progress

What’s next in store for Go & Grow?

We are working on something very exciting for Go & Grow that we can’t wait to share with you. Make sure you follow us on Instagram or Facebook to stay up to date.

Is the rate of up to 6.75%* p. a. guaranteed?

The rate is not guaranteed; however, the average net return on the Bondora platform is much higher than this. With this and our 13-year track record in mind, we believe the rate of up to 6.75%* p. a. is achievable.

The net return is capped at 6.75%* p. a. All excess returns over this percentage are reinvested to ensure you can earn the rate of 6.75%* p. a. going forward, despite no guarantee in place.

Let’s talk about risks

While it’s great to say we’ve delivered on our promises to investors so far, we need to make sure you’re aware of the possible risks.

1. The net return falls below 6.75%* p. a.

Although returns are not guaranteed, a headline benefit of Go & Grow is the high-yielding return of up to 6.75%* p. a. Compared to the net return rates achieved since Bondora’s inception, the rate of 6.75%* p. a. provides a substantial buffer. Today, the Go & Grow portfolio mirrors that of the overall composition of the loans originated at Bondora – in other words, across different risk ratings and countries. These loans were originated using our latest generation of credit analytics; a proprietary model developed for over a decade.

Therefore, the actual Internal Rate of Return (IRR) of the Go & Grow portfolio significantly outperforms the headline rate of 6.75%* p. a. – the returns generated over this amount are held back as reserves and reinvested to mitigate the risk further. Bondora has no claim on these reserves. Overall, this gives us statistical confidence that the rate of 6.75%* p. a. is deliverable for the foreseeable future. But please note that the yield achieved in past periods does not guarantee the return rate in future periods.

However, a risk that may affect our ability to deliver on the rate of 6.75%* p. a. is the number of investments we receive from investors. For example, suppose investors add more money to Go & Grow accounts than we can originate in loans. In that case, this results in a percentage of the portfolio remaining in cash (i.e., not earning a return). As an extreme measure, we could stop accepting new investors altogether and form a waiting list. However, our mission is to provide everyone with the opportunity to invest, which is why we could choose to implement an investment limit, as we’ve done with the current Go & Grow payment limit.

2. Liquidity

The plan for Go & Grow was always to have a product with fast liquidity for investors. To create it, we analyzed close to a decade of cash flow data on Bondora investor transactions to determine the inflows, outflows, and how the portfolio cash flows moved overall. This is so investors can rely on withdrawing money from their Go & Grow accounts at short notice.

In addition to this, we analyzed cash flow data from several banks and investment funds – specifically, their redemption and withdrawal cash flows, during the global financial crisis of 2007-08. This, combined with our data, has given us the necessary information to mitigate the liquidity risk as much as possible.

If Bondora cannot fulfill all withdrawals from Go & Grow, two scenarios will follow (and will be decided by whichever occurs first). We have simplified them into two sharp points below, however for a full description, please read section 7.6. of the Go & Grow Terms of Use.

The investor will receive their entire withdrawal once there’s enough money available in the Go & Grow portfolio, generated via further returns or investments.

The investor will receive partial withdrawal once there’s enough balance available – paid out each banking day until the entire withdrawal has been fulfilled.

What’s the Go & Grow payment limit, and why is there one?

As more and more people want to invest in Go & Grow, it’s crucial to ensure the quality of the portfolio powering it. So, to keep up with our growing investor community, we’re sustainably increasing our lending volume. That’s why, through careful calculations, we’ve implemented a net limit of €1000 per investor per month.

This means that we can keep the platform open for everyone to grow their money; while focusing on sustainable growth for the future. So, whether you’re new to Bondora or invested with us for years—with this change, everyone will have an equal opportunity to grow their money.

Every decision we make at Bondora is data-driven. Our goal isn’t to expand exponentially, but to grow sustainably and protect investors’ best interests. That’s why we’re being cautious about expanding our portfolio.

You can read more about the Go & Grow payment limits on our support site.

If you want to know more about Go & Grow, click here.