Albert Einstein called it the eighth wonder of the world. Warren Buffett has become one of the world’s richest men by leveraging the power it has to provide.

Compound interest has been a source of wealth consolidation for many of the world’s richest people, yet its secrets are often cloaked in mystery for the average investor. The process however is not as complex as many believe.

Principle of compounding interest

Wikipedia describes compound interest as the principle of earning interest on interest. Rather than spending the returns, any interest or income earned from an investment is immediately reinvested in the initial investment. The true power is in how quickly these returns can accelerate. Let’s illustrate with a non- financial example.

If you folded a piece of paper in half 100 times how high would it be? If you guessed the height of your house then try again – if you could achieve it the height of your paper would actually reach the edge of the known universe.

How? Exponential growth. A constant doubling can then double on itself. Two becomes four, which becomes eight, then sixteen, thirty two, sixty four and so on. Each fold takes you to double the height you had before.

Compound interest works on the same basis. You might not be able to find an investment that can double every year but if the return was 10%* per annum the same principle applies.

Examples of interest compounding over the years

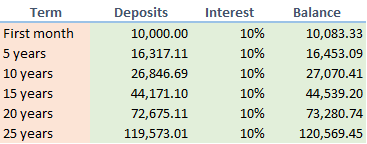

Let’s assume an investor invests €10000 into an investment that yields 10% per annum. They reinvest the funds each month back into the market, earning them 10% on their 10%. How much money would they have after 10 years?

Thanks to the benefits of compound interest the initial investment would have grown to over €27000. If they retained the investment for fifteen years their return would be more than €44000 – the additional five years would have provided them with the same amount of dollar growth as the first ten years put together. By twenty years the balance of their investment would be €73000 and after twenty five years €120,000. All of this from doing nothing other than reinvesting. Now, if funds are regularly added to the investment from other sources aswell (e.g percentage from the salary), the benefits can really accelerate.

Better returns with P2P lending

So how does peer to peer lending help this acceleration? One of the principle benefits of peer to peer lending is its ability to remove the middle man – lending institutions – from the equation. Let’s assume the investor above had made their investment through a lending institution, like a traditional bank. Assuming a margin of 2% for the institution our investor would have only yielded 8% return on their investment.

Running the same numbers based on an 8% return our investor would have achieved just over €22000 after investing for ten years, approximately €5000 less than they would have accumulated at the ten percent return. By fifteen years the funds would be €33000, after twenty years €49000 and by twenty five years the balance of the investment would be €73000 – approximately €47000 or nearly 40% less wealth than would have been achieved at the higher rate of 10%. Our investor would have only achieved in 25 years what they would have achieved in 20 years at the higher return. And this comes from only 2% difference in the yields. You can reinvest in peer to peer lending without compromising your risk profile as we detail in this blog post.

Despite the mysteries that surround it, the formula for calculating compound interest is not that complex. Rather than diving into it, you can try using any of the compound interest calculators available online that will allow you to calculate compound interest using different scenarios. You can find one here.

* the figures cited are an example and are not set to indicate expected returns.