After a positive jump in the Bondora portfolio in August, originations had slightly lower return rates as a whole in September. With that being said, Bondora originations still show good returns when compared to their target rates. Read more below:

Key statistics

- There was a 0.2% decline in Bondora returns for 2021 originations

- Q3 2021 originations returned 9.5%

- More Estonian AA and F-rated loans were originated in September than in August

- Estonian originations saw better than expected returns for low rating categories and worse than expected returns for higher rating categories

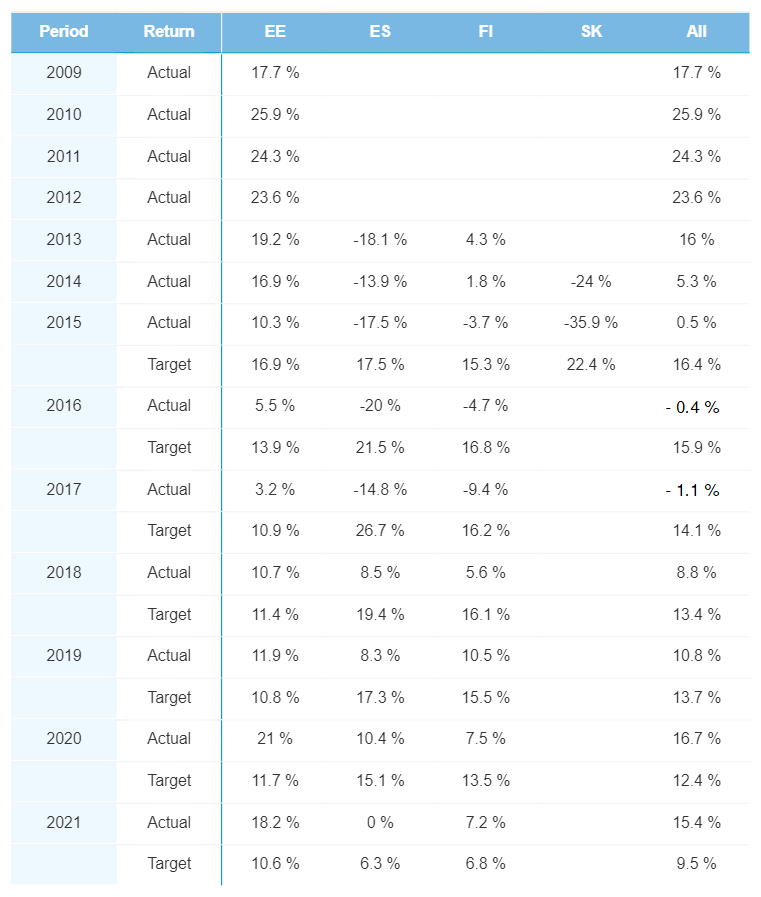

Yearly performance

A 15.4% interest rate on 2021 originations was down 0.2% compared to August. But despite this slight decline, it still holds strong above the target rate of 9.5%. Estonian originations in 2021 showed strength on the month, growing by 0.2% to 18.2%. Finnish originations had the opposite trend, declining by 0.2% to 7.2%.

2020 originations were also on the growth path, climbing by 0.2% to 16.7%. This growth was led by Estonian originations, which had a return rate of 21.0% compared to 20.6% last month.

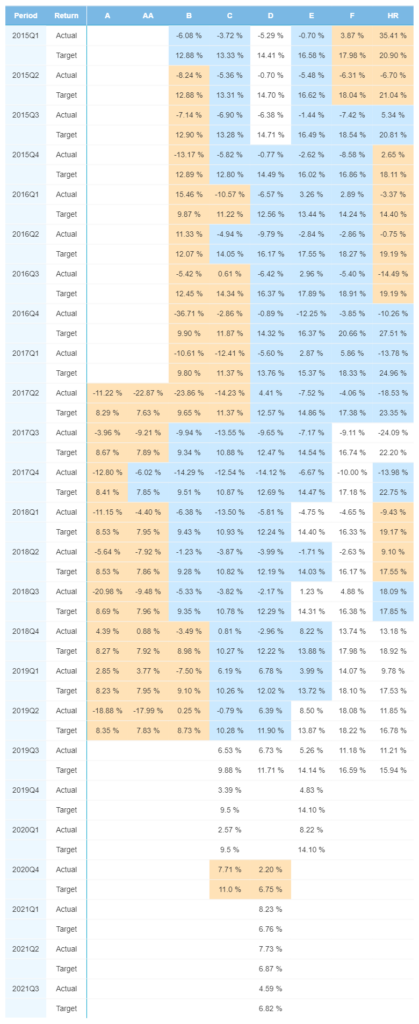

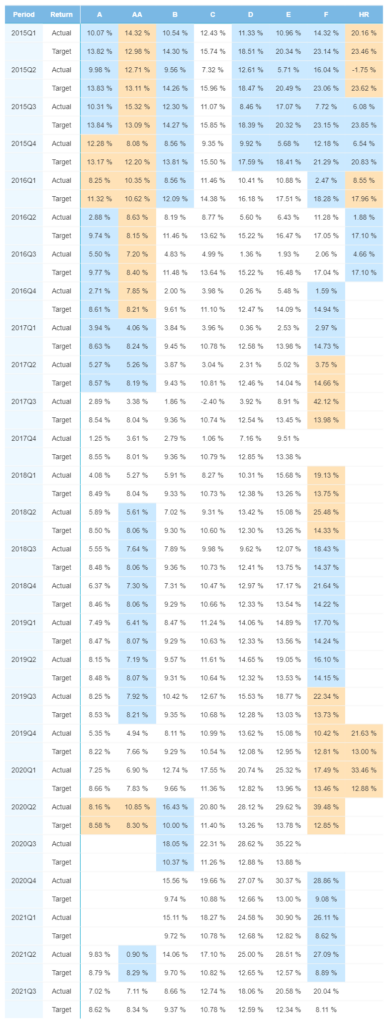

Quarterly Performance

September marked the first reported return rates for 2021 Q3 originations, coming in at 9.5% compared to their target rate of 8.9%. Additionally, the previous five quarters had higher return rates than last month, with 2020 Q4 originations returning quite well at 21.3%. This is a whopping 10.2% higher than their target rate.

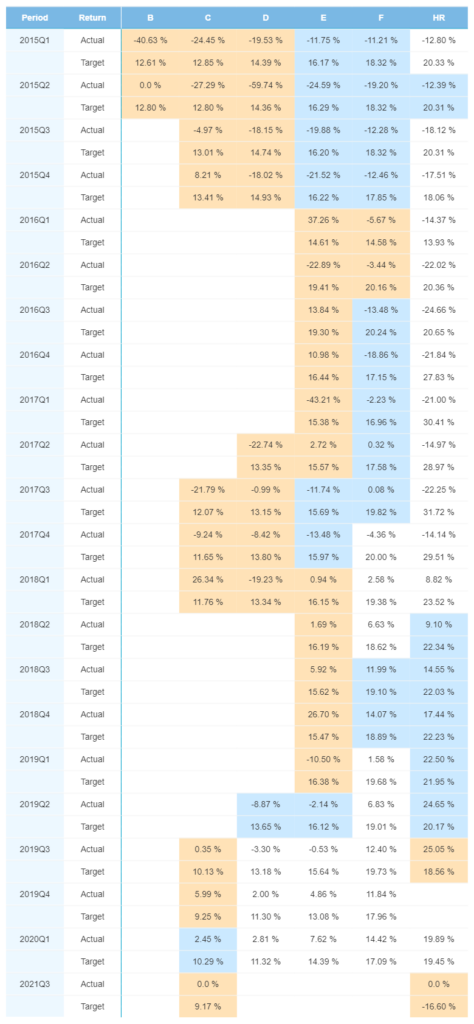

Finland

For the second quarter in a row, only D-rated loans were originated in the Finnish market. However, Q3 had a relatively low return rate of 4.6%, which is below the target of 6.8%. On the flipside, 2021 Q2 originations had a better return rate of 7.7% compared to 7.0% in August.

Estonia

In the most recent quarter, more AA and F-rated loans were originated by Bondora for Estonian borrowers. Overall, for 2021 Q3, lower-rated originations performed better than higher-rated originations with A, AA, and B-rated originations returning below their target rates. In contrast, C, D, E, and F-rated originations came in above their target rates.

One positive thing to note for 2021 Q2 originations was AA-rated originations. After returning ‑3.1% last month, this category jumped into a positive return rate of 0.9% in September. In fact, all 2021 Q2 rating categories had higher return rates than last month.

Spain

Both C and HR-rated Spanish originations for 2021 Q3 had 0% return rates. Meanwhile, all 2021 Q1 originations (the most recent quarter originations) were lower than in August. Still, HR-rated originations in the quarter remained above their target rate at 19.9%.

Conclusion

Despite having slightly lower return rates in September, Bondora originations are overall still in good standing compared to their target rates. As a whole, Q3 2021 originations had a 9.5% return rate, which is 0.6% above the target. Estonian originations still make up the bulk of the portfolio.