2022 is off to a good start, as our yearly return rate for 2021 outperforms the target rate by 5.5%. The quarterly performance has also improved from December, with all four quarters of 2021 performing above their target rates.

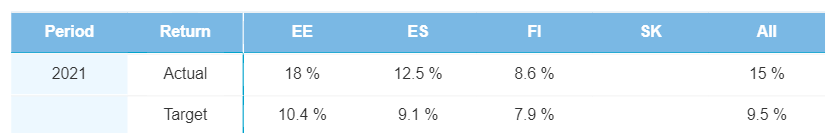

Yearly performance

It’s great to see a solid start to the yearly portfolio performance at the beginning of the new year. Our actual overall yearly return rate for 2021 increased by 0.1% to 15%, outperforming the target rate by 5.5%. Finland upped its performance from last year, and is also performing above target by 0.7%. This means that portfolio performance in Estonia, Spain, and Finland exceeds expectations.

2020 originations declined again this month by 0.3%. But, despite the drop, it’s still exceeding the target by 3.4%. This is mainly due to the robust Estonian portfolio outperforming its target by 8.8%. The Finnish and Spanish portfolios both underperform and came in below their targets by 7.3% and 7.5%, respectively.

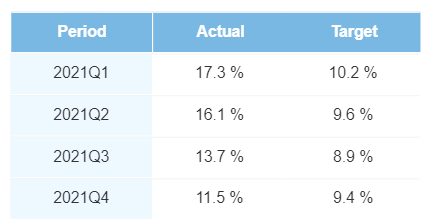

Quarterly performance

Here’s a quick outline on how returns for all four quarters of 2021 performed in January 2022:

- 2021 Q1: -0.1%

- 2021 Q2: -0.1%

- 2021 Q3: +0.3%

- 2021 Q4: +2.6%

2021 now joins the ranks of 2020 in having a ‘perfect score’, with all 2021 quarters outperforming their targets. 2021 Q1 has the strongest rate with 17.3%, exceeding the target by 7.1%. 2020 Q3 still has the highest return rate over the past several years, with an actual rate of 27.3% vs a target rate of 12.5%.

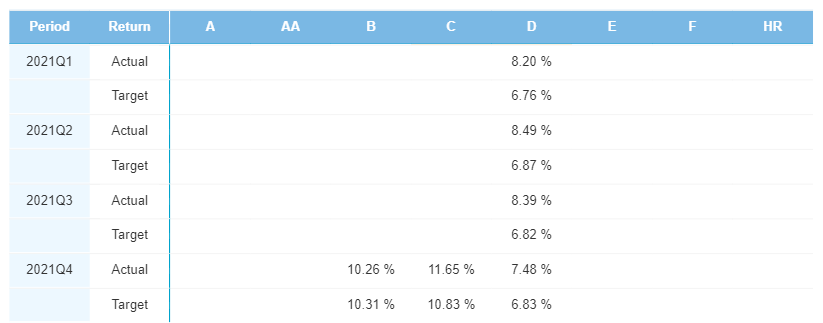

Finland

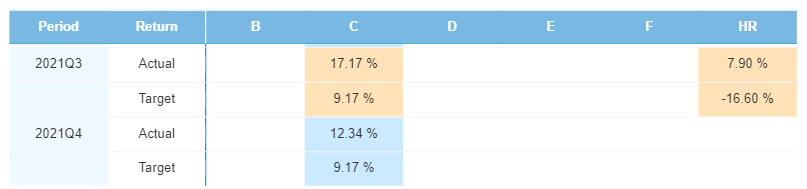

Finnish performance is very similar to last month, but there is a definite improvement. In December, the first three quarters of 2021 outperformed their targets, and Q4 was underperforming. However, this month, the B-rated category is the only category to underperform in Q4, coming in just 0.05% under target. C- and D-rated risk categories for this quarter did manage to exceed their targets.

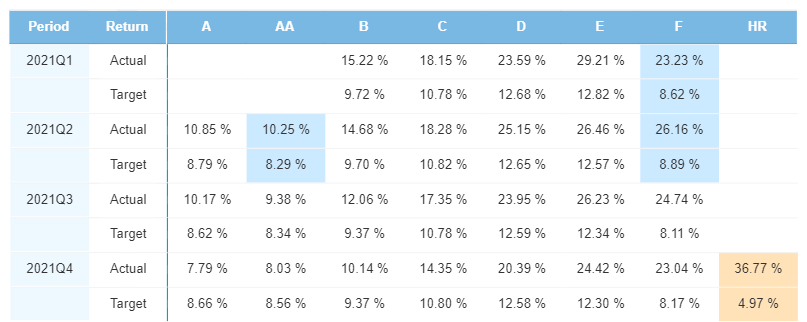

Estonia

In Estonia, 2020 Q3 until 2021 Q3 remains far above their targets. Last month, only 5 of the 8 risk categories exceeded their targets in 2021 Q4, but this month, 6 risk categories performed above their target rate. The newly relaunched 2021 Q4 HR-rated category still exceeds its target by a landslide (36.8% compared to 5.0%).

Spain

Spain remains the only country to thoroughly outperform its target in 2021 Q4, exceeding by 3.1%. Consistent with the last two months, 2020 Q1 originations remain far below the target, as we weren’t issuing loans during Spain at that time. 2021 Q3 still performs far above target. The HR-rated category in that quarter dipped significantly from 15.9% to 7.9%, but it still outperforms its target. On the other hand, C-rated loans for this quarter increased by 1.4%—exceeding the target by 8%.

Conclusion

2022 starts on a high note, as the portfolio for the last quarter of 2021 has increased its stronghold. All four quarters of 2021, as well as 2020, exceeded their targets. The yearly return rates for 2021 also outperformed the target rate by 5.5%. The Estonian portfolio performance remains a force to be reckoned with, and we’ll see how it performs in the coming quarter.