Transferring money has never been easier. Today, there are so many ways to transfer money out and in to your bank account that the problem now lies with choosing the best option, not just going via your bank (as it used to be). The speed, fees and rate of exchange are the three main things you should consider before deciding on the method you choose to transfer money. Of course, you should also consider the reputation of the provider and if they are part of a trusted and regulated organization.

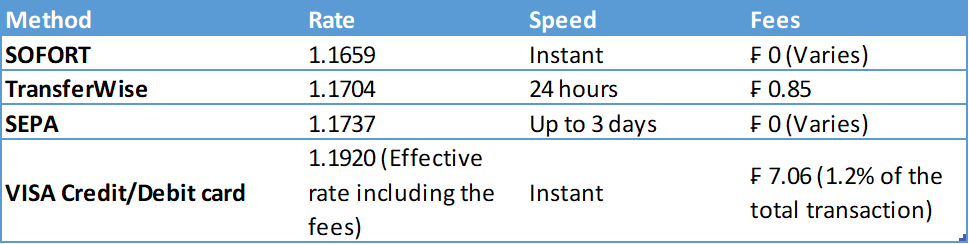

Recently, one of our Switzerland-based investors tested 4 different methods of transferring money for us. The aim was to find out the most cost effective option for investors looking to transfer money from a non-euro currency origin. Take a look at the results of CHF to EUR below.

A quick overview of the different payment methods

SOFORT – An immediate and direct transfer of funds which works on the basis of online banking. All information related to the payment is delivered to your bank in an encrypted form. Payments are instant.

SEPA – Single Euro Payments Area is the format used for cross-border Euro bank transfers. The aim of SEPA is to make it as easy to transfer money across European borders as it is to make transfers domestically. Payments are usually processed within 24 hours but can take up to 3 working days.

TransferWise – An innovative platform that allows customers to make currency transfers at the mid-market rate. TransferWise is authorized in the UK by the Financial Conduct Authority (FCA). Transfers are usually processed within 24 hours but are dependent on how you pay, the countries you are sending from and to and security checks.

VISA Debit/Credit – A Visa card is something that links directly to your bank account and is probably one of the most common payment methods globally. Payments are instant.

The winner?

In this scenario, the most cost effective option was a direct transfer from a Swiss bank account (Post Finance) to Bondora using SOFORT. Here, the funds were already in a EUR account within the bank. Overall, we believe SOFORT to be the winner as it ticks all boxes for speed, the best rate of exchange and no fees.

Overall, you should see if you can open a EUR account within your bank and then make the transfer via SOFORT or SEPA to your Bondora account. If that’s not an option, TransferWise would be the most cost effective followed by a SEPA payment from a currency other than Euro. The least favorable option was certainly via a credit card (despite the payment being made immediately) mainly due to the high fees associated.

With all of this in mind, each bank is different so make sure you check with them in advance what fees are associated with what type of transfer. For example, Santander in the UK charge up to £25 for an international transfer. No thanks.

What is your favorite method to use to make a deposit? Let us know in the comments below.