In October, we saw favorable increases in investments and originations. Originations exceeded €15M, and investments €14M. This puts us on track for a good Q4 in 2022. Spanish originations exceeded 1M once again. Read more:

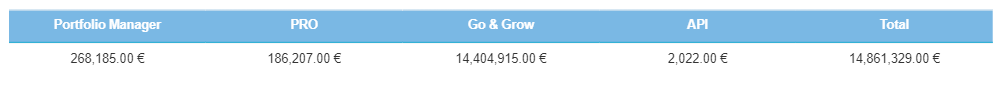

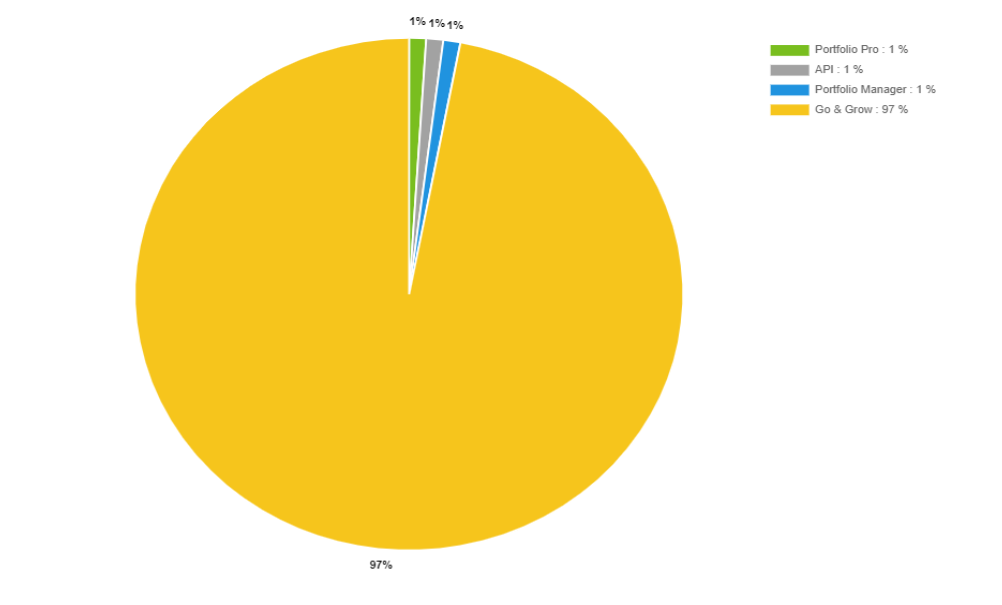

Investment by product

In contrast to September, investments for all products increased in October. All in all, they totaled €14,861,329—a noteworthy 21.3% increase. The specific increases for each product can be seen below:

Go & Grow + 21.3%

Portfolio Manager + 22.1%

Portfolio Pro + 19.9%

API + 56.1%

Once again, Go & Grow’s figures had the most significant effect, as it is the most used investment product, making up 96.9% of all investments. It received €14,404,915 in investments. Portfolio Manager received €268,185, and Portfolio Pro had €186,207. The API made up the remaining €2,022.

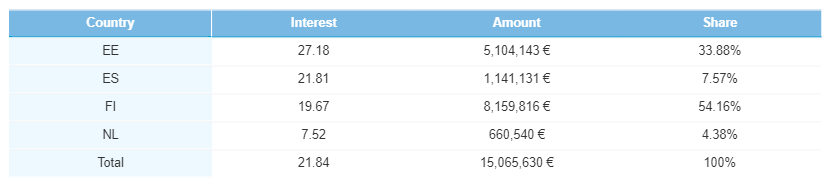

Loan originations

October was a good month for loan originations, with the overall number rising by 19.9% to €15,065,630. Every loan market had increased its originations.

Country breakdown

Finland still has the largest share of originations, totaling 54.2%, which is €8,159,816 worth of loans.

The Estonian market originated €5,104,143 worth of loans, totaling a 33.9% share.

The Spanish market also continues increasing its originations, now taking up a 7.6% share, totaling €1,141,131 worth of loans. This is the 2nd month in a row that this market exceeds €1M in originations.

The Netherlands loan market, launched on 23 September, has increased its origination share to 4.4% of the total portfolio, equaling €660,540 worth of loans.

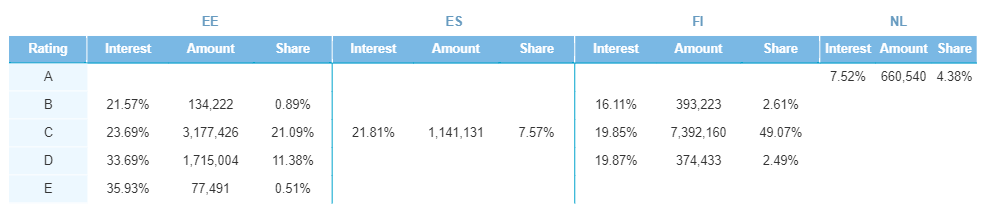

The average interest rate decreased from 22.6% to 21.8%. Like last month, the average Spanish interest rate remained at 21.8%. Estonia’s average interest rate decreased slightly to 27.2%. In Finland, it increased by 0.1% to 19.7%. The Dutch market average interest rate remained standing at 7.5%.

As always, C-rated loans are the most populated risk-rating category in all our markets. Estonia’s C-rated share decreased from 23.7% to 21.1%. In contrast, it increased from 46.2% to 49.1% in Finland. We only originate C-rated loans in Spain, making up 7.6%, a decline from September’s 8.5% share. Lastly, we have the Netherlands, where only A-rated loans were originated, totaling a 4.4% share.

In Estonia, the D-rated loan category decreased from 13.3% to 11.4%. The B-rated category continued to climb, growing from 0.6% in September to 0.9% in October.

In Finland, the D-rated category decreased from 2.9% to 2.5%.

Good gains for loan markets

October made impressive gains for originations and investments. Especially when considering the declines from September. Investment funding increased by 21.3% to over €14M. And loan originations exceeded €15M. This puts us on track for an excellent end-of-year.

Want to see more detailed information? Head to our public statistics page for the most up-to-date stats!